In 2023, Vietnam’s wood and wood products (W&WP) exports faced challenges, marked by a general decline in November. Despite global economic pressures, certain markets, such as Canada, France, Taiwan, India, Cambodia, and Mexico, displayed growth. Looking ahead, the outlook suggests a potential recovery in 2024, driven by anticipated global interest rate decreases and a rebound in the real estate market.

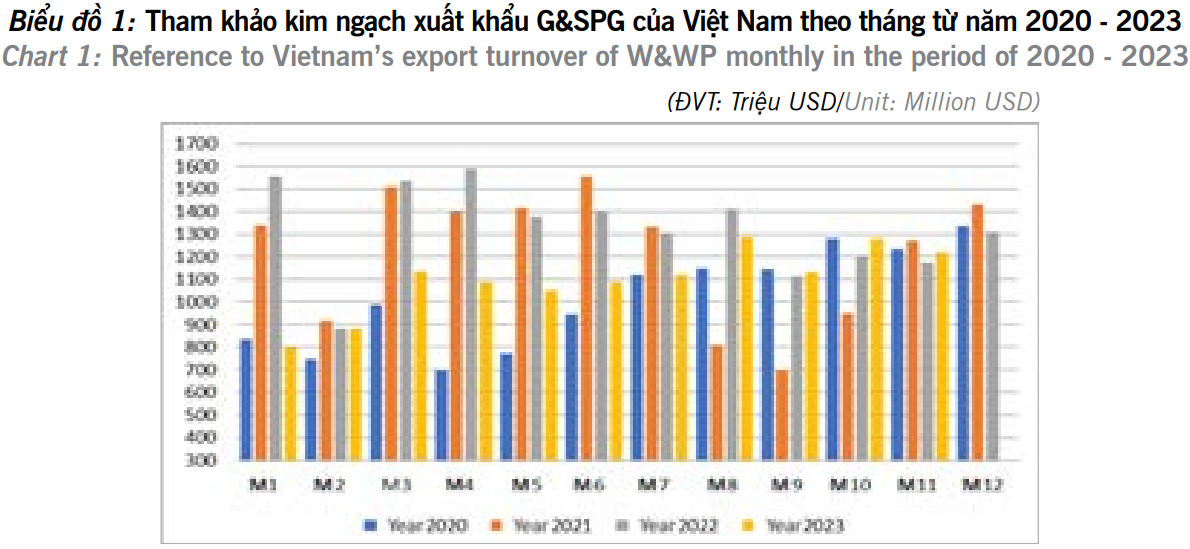

As per initial data from the General Department of Vietnam Customs, Vietnam experienced a slight dip in export revenue for wood and wood products (W&WP) in November 2023, reaching $1.22 billion. This reflects a 4.7% decline from October 2023 but demonstrates a 3.99% increase compared to November 2022.

Among these figures, the export revenue for wood products totaled $868 million, registering a 0.6% decrease compared to October 2023, yet showing a noteworthy 14% increase compared to the corresponding period in 2022. Over the initial 11 months of 2023, the overall wood and wood products (W&WP) export turnover for the entire country amounted to $12.12 billion, indicating a 17.5% decline compared to the same period in 2022. This category secured the 6th position in terms of value among Vietnam’s export commodities and groups.

Within this context, the export turnover for wood products nearly reached $8.24 billion, marking a 19% decline compared to the corresponding period last year. This segment accounted for 67.95% of the total wood and wood products (W&WP) export turnover, showing a slight decrease from 69.1% compared to the same period in 2022. In the initial 15 days of December 2023, W&WP export turnover reached $627 million, indicating an 8.7% increase compared to the same period in November 2023.

Hence, there is a notable decline anticipated in wood and wood products (W&WP) export turnover for the year 2023 compared to the previous year. The primary factors contributing to this downturn include global inflation, particularly in pivotal W&WP export destinations like the United States, Europe, and Japan, as well as the sluggishness in the real estate markets of major countries such as China. Forecasts suggest a gradual improvement in W&WP export turnover as numerous large countries worldwide are expected to lower interest rates in 2024. Additionally, the real estate market is anticipated to experience growth once again in the latter half of 2024.

FDI wood enterprises

During November 2023, the wood and wood products (W&WP) export turnover of Foreign Direct Investment (FDI) enterprises surpassed US$577 million. This reflected a 2.57% decrease compared to the previous month but demonstrated an 8.5% increase over the same period last year. Specifically, the export turnover of wood products within this category amounted to US$534 million, indicating a 0.95% decrease compared to October 2023, yet showcasing a notable 15% increase over the same period in 2022.

In the initial 11 months of 2023, Foreign Direct Investment (FDI) enterprises recorded a wood and wood products (W&WP) export turnover of US$5.53 billion. This indicated a 19.13% decrease compared to the same period last year, constituting 45.63% of the total W&WP export turnover for the entire industry. This percentage is down from 51.2% in the corresponding period last year. Within this, the export turnover for wood products amounted to US$5.03 billion, marking a 19.28% decline compared to the same period last year. Notably, it accounted for 91% of the total W&WP export turnover of FDI enterprises and 61.13% of the overall export turnover of wood products in the industry. This percentage for the same period in 2022 was slightly higher at 62.48%.

EXPORT MARKETS

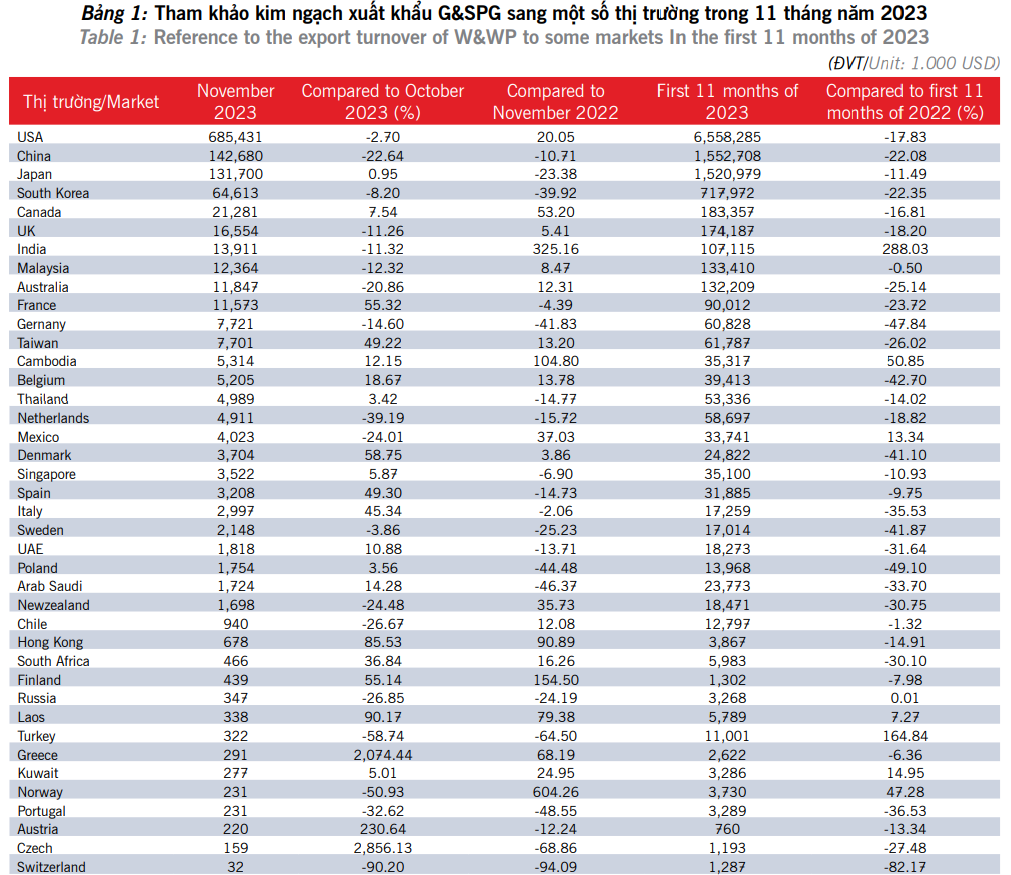

In November 2023, the export turnover for wood and wood products (W&WP) experienced a significant decline to key markets compared to the previous month. Notably, there was a sharp decrease in exports to China by 22.64%, the UK by 11.26%, and India by 11.32%. Meanwhile, the export turnover to the US and South Korean markets saw a slight reduction during the same period.

During the same period, wood and wood products (W&WP) export turnover saw positive growth in various markets. There was a notable increase of 7.54% in the Canadian market, a substantial 50.32% increase in the French market, a robust 49.32% increase in Taiwan, a noteworthy 12.15% increase in Cambodia, and a solid 18.67% increase in Belgium compared to the previous month.

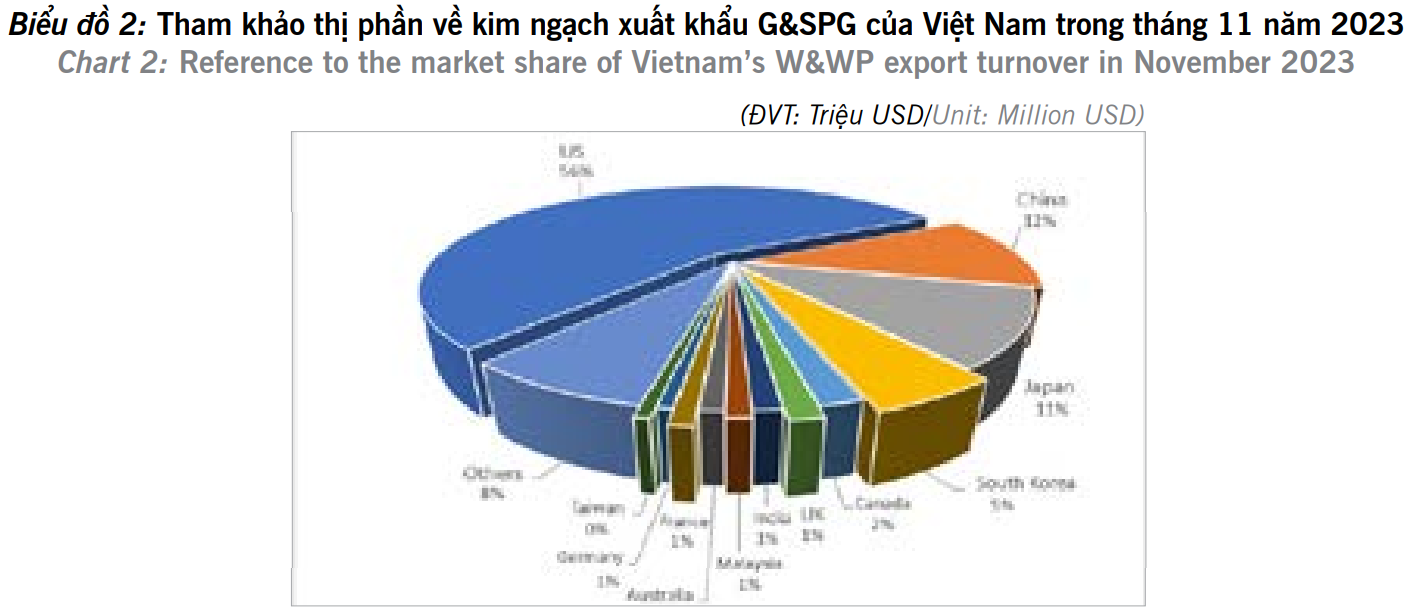

Furthermore, in the initial 11 months of 2023, the United States, China, and Japan continued to be the principal W&WP export markets for Vietnam.

Nevertheless, there was a significant decrease in export turnover compared to the same period last year, with the United States experiencing a decline of 17.83%, China decreasing by 22.08%, and Japan decreasing by 11.49%. Additionally, W&WP export turnover to several other key markets, such as Korea, Canada, England, Australia, France, and Taiwan, also saw substantial decreases compared to the same period in 2022.

Conversely, a few markets demonstrated growth during this period, with India witnessing an impressive increase of 288%, Cambodia growing by 50.85%, and Mexico experiencing a notable increase of 13.34%.

Source: Goviet.org.vn

See more about: Vietnam’s Wood and Timber Imports: 11-Month Analysis