In just the first 11 months of 2019, the global plywood trading volume reached 121,514 transactions, an increase of 25% compared to the same period in 2018.

Asia remains the region with the most plywood exporters in the world, with China leading the way (30%), followed by Indonesia (23%), Hong Kong (6%), India (5%), and South Korea (3%). Vietnam also ranks among the plywood-exporting countries, with a share of 2.3% (according to Tradesparq).

Vietnam has many plywood manufacturing plants, but most are aimed at producing packaging materials (for machinery components) for export to Japan or South Korea. Additionally, plywood is used in construction projects for formwork. This product has advantages in terms of durability, resistance to warping, and good structural strength. However, it has not yet been widely used in the furniture industry.

The following report provides an overview of the Plywood export situation up to July in 2024, with data obtained directly from reliable sources.

Overview

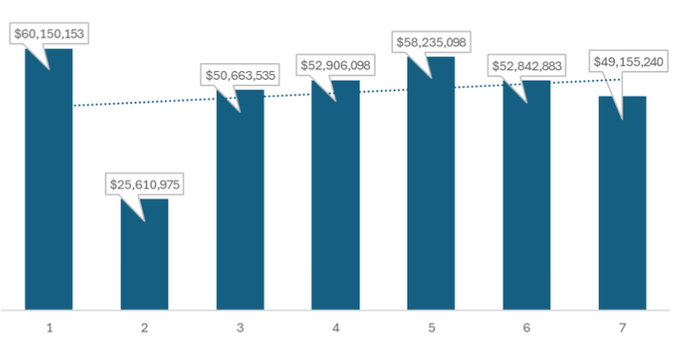

Plywood Exported Value by Month

Overall, Vietnam’s export situation in the first 7 months has been very positive, reaching $349,563,983. According to the chart below, the overall export value trend shows a slight decrease each month, which can be seen more clearly through the daily export chart. February saw a significant drop with only $25,610,975, while January had a value more double that of February. This discrepancy could be attributed to the long Lunar New Year holiday in Vietnam. Almost remaining months fluctuated slightly between 49 million to over 53 million dollars.

Top Exporter in Vietnam

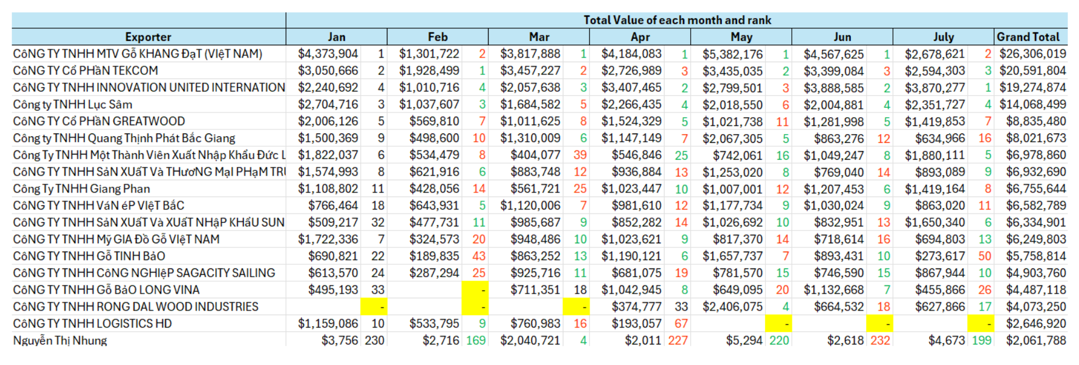

Top Plywood Exporter each month by Value and Rank

A few major companies, such as KHANG DAT WOOD COMPANY LIMITED (VIETNAM), TEKCOM CORPORATION, INNOVATION UNITED INTERNATIONAL CO., LTD (VIETNAM), Luc Sam Company Limited, and GREATWOOD CORPORATION, consistently rank among the top 10 plywood exporters by value. Their total monthly export values range from $1,000,000 to $3,000,000, and even exceed $5,000,000 in some cases. RONG DAL WOOD INDUSTRIES CO., LTD seems to be a potential exporter as its production suddenly reached nearly $2,500,000 in May, despite lower figures in other months. Overall, there is not much fluctuation in the ranking of these exporters, and their export values reflect the general market trend of plywood exports. The other companies’ export volumes do not vary significantly.

Top Importer: Challenges and suggestions

Top Plywood Importers: Value, Rank and Trend

The largest importers include MOHAWK CARPET DISTRIBUTION (C/O ALADDIN MANUFACTURING), MUSTARD SEED FOREST INC, USA TIMBER LLC, GALLEHER LLC, and ASHLEY FURNITURE INDUSTRIES LLC. These companies each imported approximately $10,000,000 worth of plywood over seven months, with monthly import values ranging from $1,000,000 to $3,000,000. The sudden drop in import volume in July by MOHAWK CARPET DISTRIBUTION is concerning and needs further investigation to determine the cause and possible recovery strategies, similar to USA TIMBER LLC. Most of the other top importers have seen an increase in their total import value, which is a positive sign.

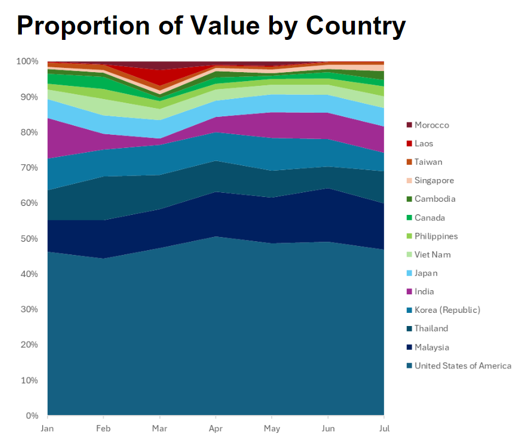

Importer Point: United States of America

The U.S. is the largest market, with an import value three times that of the second-largest market. Most countries have shown an increasing trend in plywood imports, which is good news for Vietnam. Other notable markets include Malaysia, Thailand, South Korea, India, Japan, and others, indicating that Vietnam primarily exports to Asian countries. Therefore, focusing on the U.S. and Asian markets will yield the best results. For other markets, Vietnam will need to offer higher-end products, such as melamine or laminate-coated plywood.

Conclusion

Vietnam’s export market is very promising, with a figure of $349,563,983 (Jan to Jul); the average monthly export value fluctuates between $25,000,000 to $60,000,000.

Vietnam’s main market is the USA, Malaysia, Thailand, Korea, India.

It is advisable to focus on the USA and Asia countries market.

If you want the full report you can get it Here or email us to check out more report from us.