Vietnam’s export market for particle board has shown remarkable dynamism in the first seven months of 2024, positioning the country as a significant player in the global wood product industry. As one of the key sectors within Vietnam’s export portfolio, the particle board industry has been instrumental in driving economic growth and strengthening the country’s trade relationships, particularly within Asia. The period from January to July 2024 witnessed Vietnam exporting particle board to 16 different countries, highlighting the global demand for Vietnamese wood products. The total export and import value during this period reached an impressive $1,509,576,572. This figure highlights the significant role that Vietnam plays in the global particle board market.

Export Trends of Particle Board

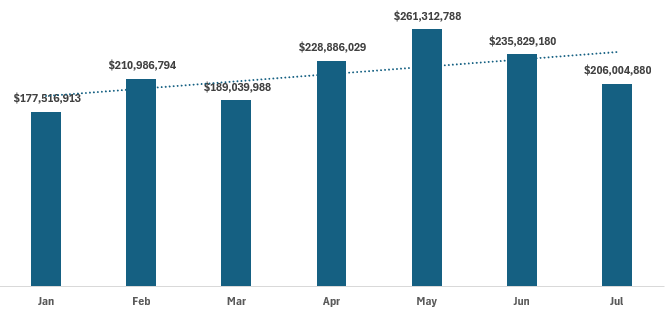

The export trend of particle board from Vietnam has exhibited fluctuations, with notable variations from month to month. The highest export value was recorded in May 2024, after which there was a gradual decline in June and July. February and April also experienced significant increases compared to the preceding months, indicating some seasonality or external factors influencing demand.

Dominance of China as a Key Market

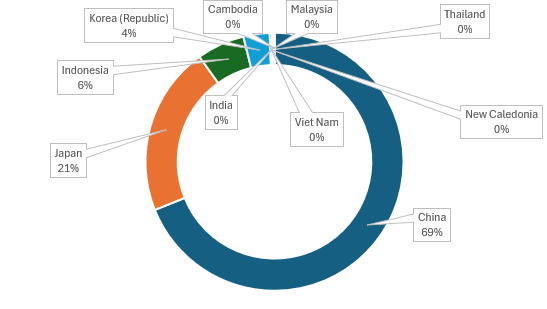

China emerged as the dominant importer of Vietnam, with a staggering import value of $1,040,205,259. This accounts for 69% of the total export value, making China the most crucial market for Vietnam’s particle board industry. The prominence of China as a top importer underscores the strong trade ties between the two countries and the importance of the Chinese market for Vietnam’s wood product exports.

Top 10 Import Countries from Jan to Jul 2024

Leading Exporters

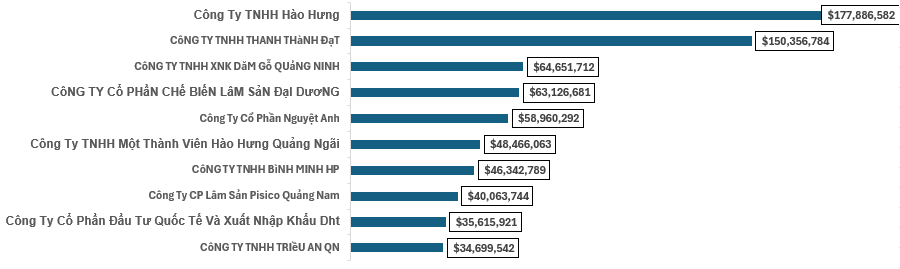

Top 10 Exporter

Hao Hung Company Limited has established itself as the largest exporter of particle board from Vietnam during this period. This company’s leadership in the export market highlights its significant role in the industry, contributing a considerable share to the country’s total export volume.

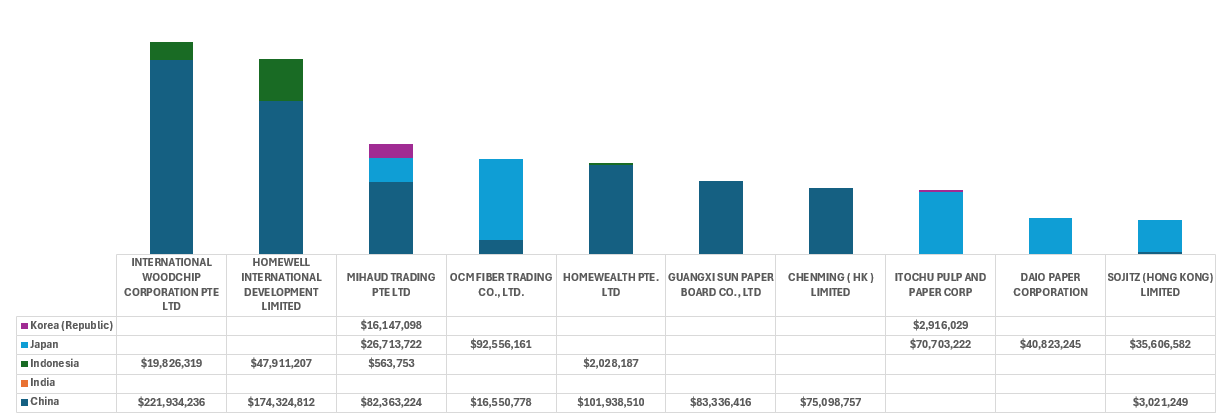

Top Importers and Market Distribution

The top importers of Vietnamese particle board are primarily located in China, Japan, Indonesia, and Korea (Republic). The company with the largest import value is INTERNATIONAL WOODCHIP CORPORATION PTE LTD, which operates branches in both China and Indonesia, with a total import value of $241,760,555. Additionally, the concentration of exports to major Asian economies, particularly China, signifies the strategic importance of regional trade alliances in sustaining the growth of Vietnam’s wood product exports.

Monthly Insights

In May 2024, the highest export value was recorded, marking a peak in the export activity for the first half of the year. This surge can be attributed to increased demand from key markets, possibly driven by seasonal factors such as construction booms or inventory restocking cycles in importing countries. The rise in export values during this month suggests that Vietnamese exporters were able to capitalize on favorable market conditions, efficiently meeting the heightened demand.

In July 2024, Vietnam exported particle board to nine countries, with China maintaining its position as the largest importer. The sustained demand from China highlights the country’s ongoing need for particle board, driven by its robust construction and furniture industries.

Conclusion

Vietnam’s particle board export market has shown resilience and adaptability in the first seven months of 2024, with China being the dominant importer. The performance of companies like Hao Hung Company Limited and INTERNATIONAL WOODCHIP CORPORATION PTE LTD further emphasizes the strength and competitiveness of Vietnam’s particle board industry on the global stage. As Vietnam continues to strengthen its trade relationships and expand its market reach, the country is well-positioned to maintain its status as a key player in the global wood product market.

If you want the full report you can get it Here or email us to check out more report from us.