Vietnam’s finger joint panels are among the most commonly exported products, with plywood and finger joint panels accounting for 6.7% of total wood exports (according to the Vietnam Timber and Forest Products Association’s 2023 report). This indicates that this is a major export sector with high volumes that can serve any market.

Vietnam’s wood products have the advantage of stable quality, high-quality core boards, beautiful surfaces, and abundant raw materials, primarily from well-managed plantation forests. Therefore, with the global race towards carbon emissions reduction, Vietnam’s wood products should be more widely recognized and are likely to become a promising export market that attracts the largest importers.

The following report provides an overview of the Finger Joint Panels export situation up to July 2024, with data obtained directly from reliable sources.

Overview

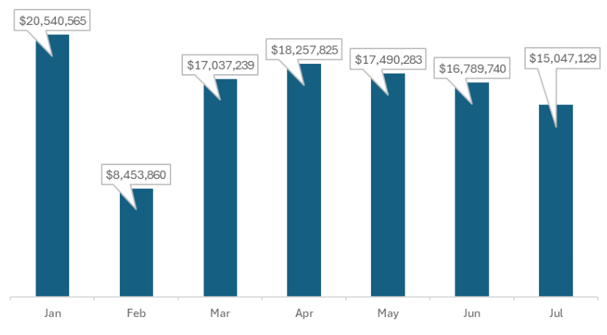

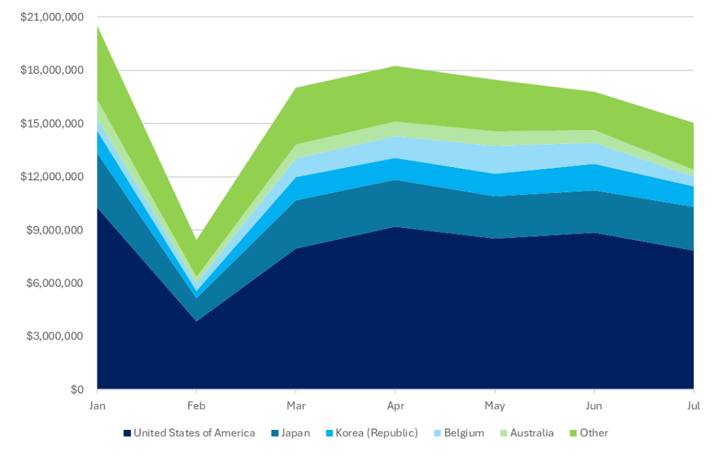

Overall, Vietnam’s export situation in the first 7 months has been very positive, reaching $113,616,642. According to the chart below, the overall export value trend shows a slight decrease each month, which can be seen more clearly through the daily export chart. February saw a significant drop with only $8,453,860, while January had a value nearly three times that of February. This discrepancy could be attributed to the long Lunar New Year holiday in Vietnam. The remaining months fluctuated slightly between 15 million to over 18 million dollars.

Top exporter and market share

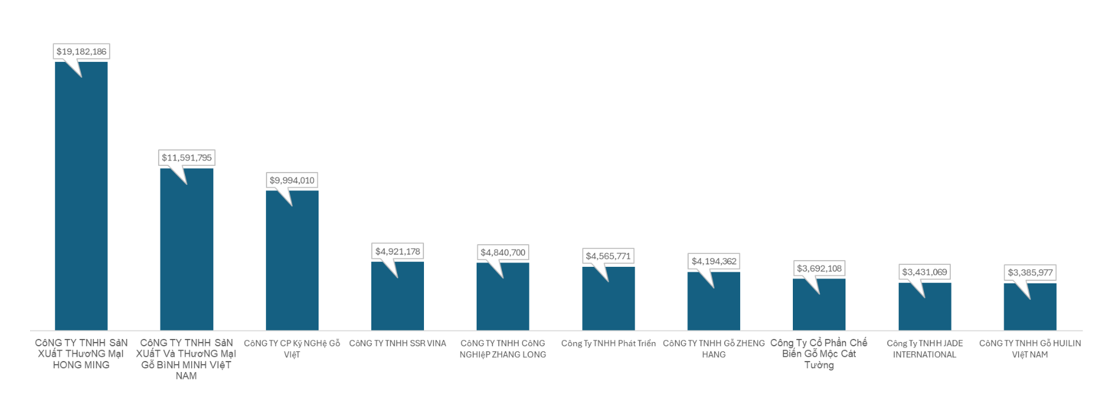

Top 10 Finger Joint Panels Exporter by Value (up to July)

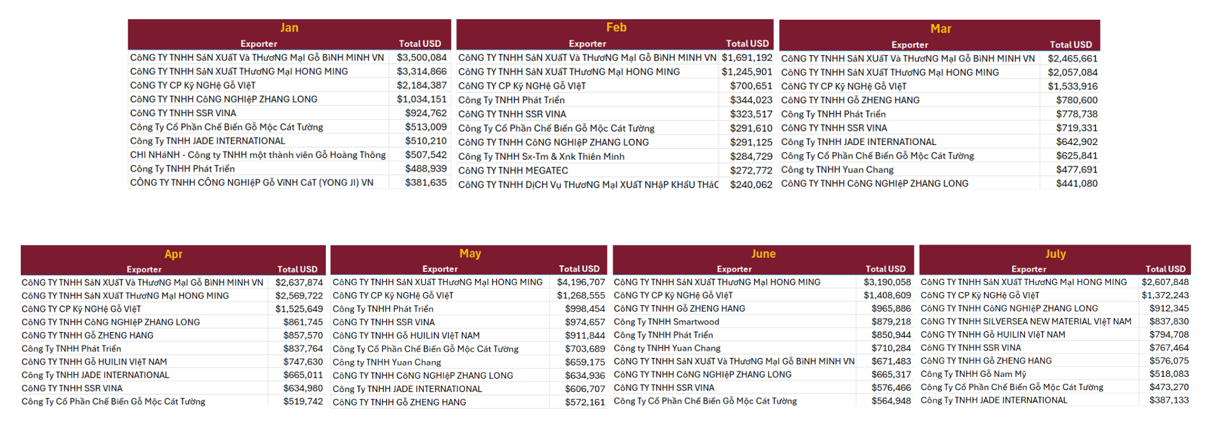

Top 10 Finger Joint Panels Exporter each month by Value

It can be seen that most companies in the top 10 each month include: Hong Minh Trading Production Co., Ltd.; Binh Minh Wood Production and Trading Co., Ltd.; Vietnam Wood Industry Joint Stock Company; Phat Trien Co., Ltd.; and SSR Vina Co., Ltd. with total monthly values ranging from $850,000 to $2,000,000 or even $3,000,000. Additionally, companies like Silversea New Material Vietnam Co., Ltd. and Huilin Vietnam Wood Co., Ltd., although only appearing in the top rankings in some months, each time they did, they achieved over $700,000—a promising figure.

Vietnam’s Wood Import Markets and Opportunities

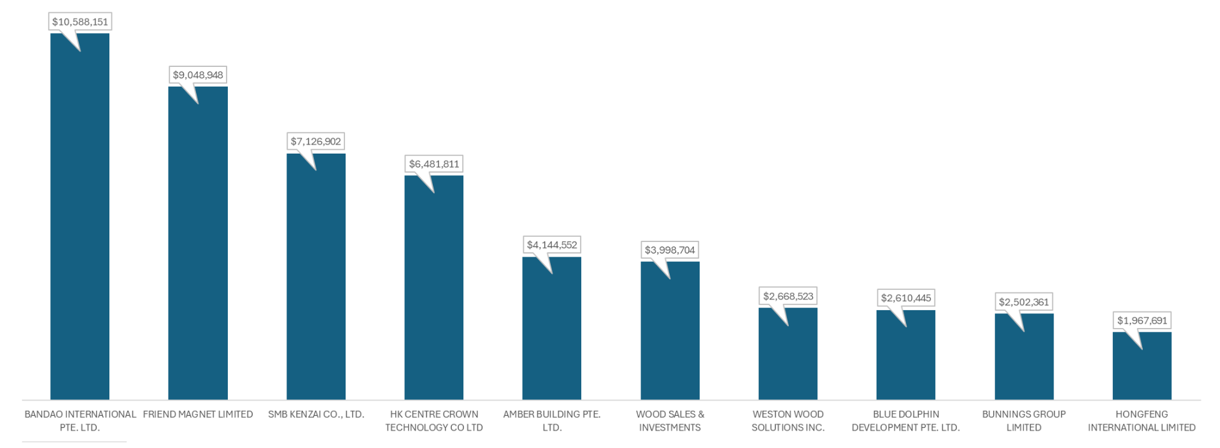

Top 10 FJ panels Importers by Value (January to July)

Importer Point: United States of America

Notable names include: Bandao International Pte. Ltd. (USA), SMB Kenzai Co. Ltd. (Japan), Friend Magnet Limited (USA), Amber Building Pte. Ltd. (USA), and HK Centre Crown Technology Co. Ltd. (USA), with import values typically ranging from $500,000 to $3,000,000 or even $4,000,000. Moreover, 4 out of 5 of the largest importers are from the USA, showing that Vietnam is a favored market by the United States; also, the SMB company of Japan shows that Japan is a long-term and significant market as its total value is very promising (around $1,000,000) and not too different from others.

Opportunities and Development of Vietnam’s FJ Panels Export Market

Top 5 country importers monthly and its proportion

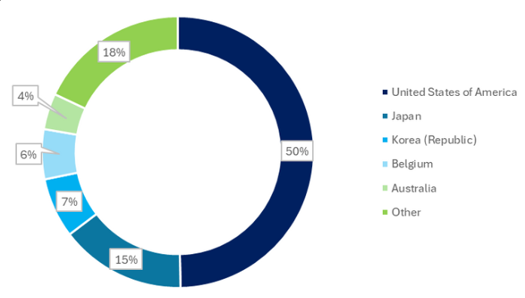

The USA market consistently accounts for a large proportion of around 50% of the import volume, with values ranging from over $8,000,000 to $9,000,000 per month. Next is the Japanese market, accounting for about 15% consistently over time with a total value of around $2,000,000 per month. This shows that Vietnam’s main markets are the USA and Japan, and focusing efforts on the USA market will yield the best results. Additionally, the steady value in the Japanese market can create a consistent monthly revenue with less competition. Furthermore, Belgium, as one of the top 5 importers, indicates that Vietnam’s finger joint panels are of high quality and have the potential to expand further if the European market is tapped into

Top 5 country importers proportion (July)

The July market is a representative example for other months as the import proportions among countries do not vary significantly or shift much between markets.

Besides the countries mentioned above, there are also some European and Southeast Asian countries that are potential markets, with detailed figures provided in the report. Please refer to the detailed information below.

Conclusion

Vietnam’s main market is the USA, and the stable market to pay attention to is Japan.

It is advisable to focus on the USA market for the highest effectiveness, while concentrating on the Japanese market will help certain some part Vietnam’s export supply due to the steady import market; additionally, exploring European and Asian countries, particularly Southeast Asia, should also be considered and researched to get higher volumes

If you want the full report you can get it Here or email us to check out more report from us.