Introduction: In August 2024, Vietnam’s Export made a significant impact on the U.S. market by exporting various types of furniture under HS Code 9403, with a focus on wooden and non-wood furniture products. The total export value to 11 U.S. seaports reached an impressive $354,996,095, making it a pivotal month for trade between the two nations. This article delves into the details of this export boom, highlighting key players, port destinations, and the types of wood that contributed to this achievement.

Top Highlights of Vietnam’s Export in August 2024

The exports encompassed products under HS Code 9403, which includes a variety of furniture and parts. A remarkable 818 Vietnamese exporters and 1,342 U.S. importers were involved, illustrating the vast network supporting this trade. The leading Vietnamese exporter was Rochdale Spears Ltd, while Regent Fine Furniture Ltd topped the list of importers.

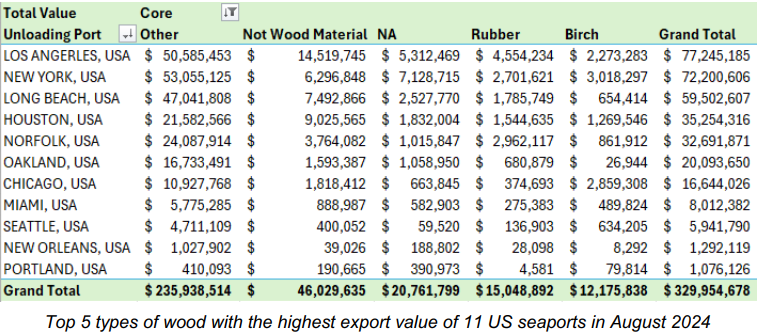

11 Key U.S. Seaports Receiving Vietnamese Exports

Among the 11 seaports in the U.S., Los Angeles, New York, and Long Beach were the primary destinations. These top three seaports alone accounted for a significant portion of “Core” wood exports, with each port handling over $40 million in shipments. This reveals the critical role that these ports play in the distribution and market penetration of Vietnamese furniture.

Product Diversity: 28 Types of Wood and More

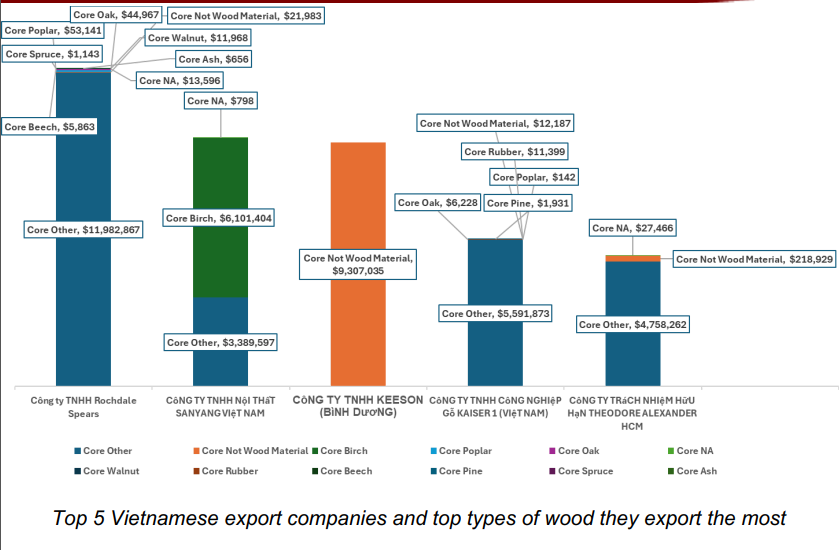

Vietnamese products exported to the U.S. were made from 28 different types of wood, including mixed wood and non-wood materials like iron and steel. The “Not Wood Material,” “NA,” and “Rubber” categories stood out, with export values of $46 million, $20.7 million, and $15 million respectively, indicating that non-core wood types had a substantial contribution to the export numbers.

*Core Other: materials from 2 or more types of wood

*Core NA: no information about ingredients

For instance, birch exports were valued at $12.1 million, and ports like Chicago saw concentrated shipments worth over $2.8 million, showcasing a regional preference for specific wood types.

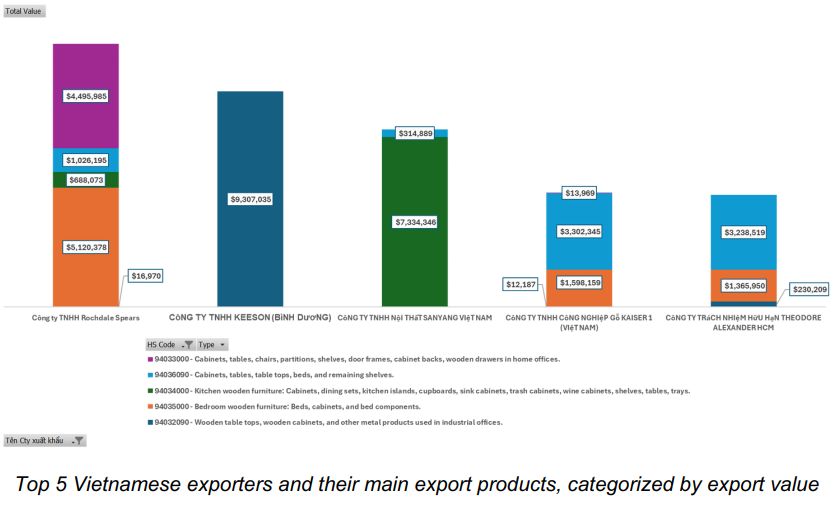

Top 5 Vietnamese Exporters and Their Products

The top five Vietnamese exporters contributed significantly to the export value, focusing on kitchen, bedroom, and office furniture. The two dominant export categories were 94034000 and 94035000, reflecting a global demand for these specific types of wooden furniture from Vietnam.

These companies had diverse export profiles, with some focusing on “Core Other” materials (furniture made from two or more types of wood) and others specializing in products like birch and non-wood furniture.

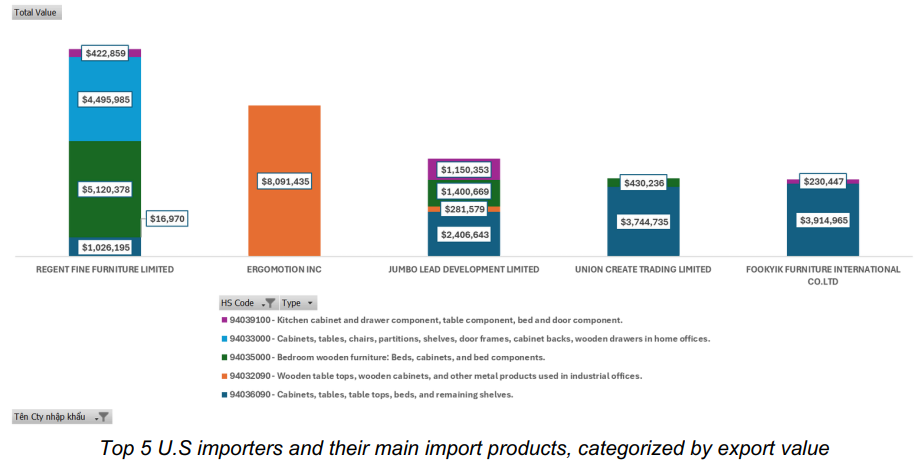

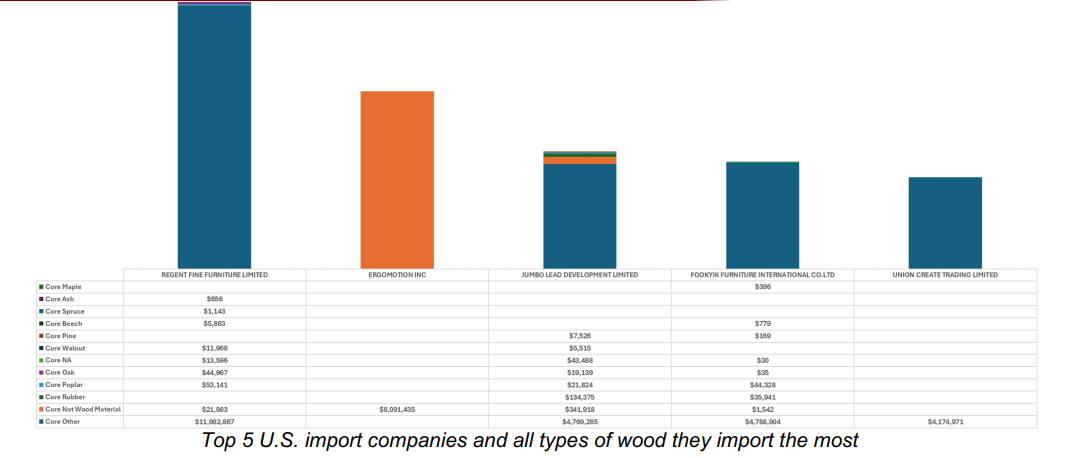

Top 5 U.S. Importers and Their Import Trends

The leading U.S. importers had diverse portfolios, each specializing in different categories of furniture and wood products. Regent Fine Furniture Ltd emerged as a leader across multiple categories, highlighting their market influence and demand for Vietnamese products.

All five importers had a common preference for the “Core Other” category, with Regent Fine Furniture importing approximately $11.98 million worth of these products. This reflects a strong market inclination for varied wood products that go beyond traditional single-wood furniture.

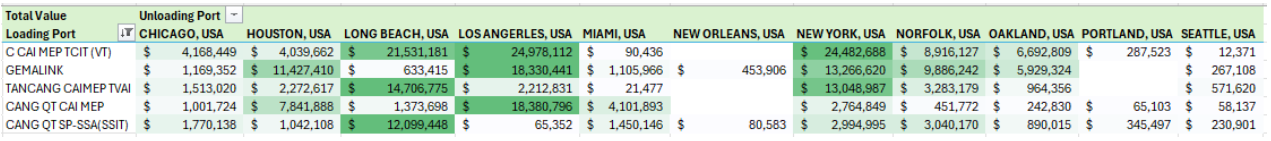

The Importance of Loading Ports in Vietnam

Vietnamese loading ports played a crucial role in facilitating these exports. The top port was Cai Mep TCIT (VT), which served as a major hub for shipments bound for the U.S. West Coast, particularly Los Angeles and Oakland. This distribution emphasizes the importance of multiple loading points within Vietnam to support the growing demand in the U.S. market.

Conclusion: A Bright Future for Vietnam-U.S. Furniture Trade

August 2024 was a monumental month for Vietnam’s furniture export industry, with substantial shipments to 11 key U.S. seaports. The trade, dominated by wood and non-wood furniture products under HS Code 9403, not only highlights Vietnam’s production capabilities but also indicates a positive trend for future exports. As the demand for varied wood types and furniture styles continues to grow, both Vietnamese exporters and U.S. importers are poised to capitalize on this thriving trade relationship.

Read more detail about our report Here.

You can read more articles by visiting our blog here.