During the first term of Donald Trump’s presidency, Vietnam emerged as one of the largest beneficiaries of the trade conflict with China. However, business groups and analysts have warned that Hanoi may become a casualty of its own success if the incoming president follows through on his threats to impose sweeping trade tariffs upon returning to the White House. In recent years, Vietnam has amassed the fourth-largest trade surplus with the United States, following China, Mexico, and the European Union, as global manufacturers relocated their production facilities away from China to mitigate the effects of Trump’s tariffs.

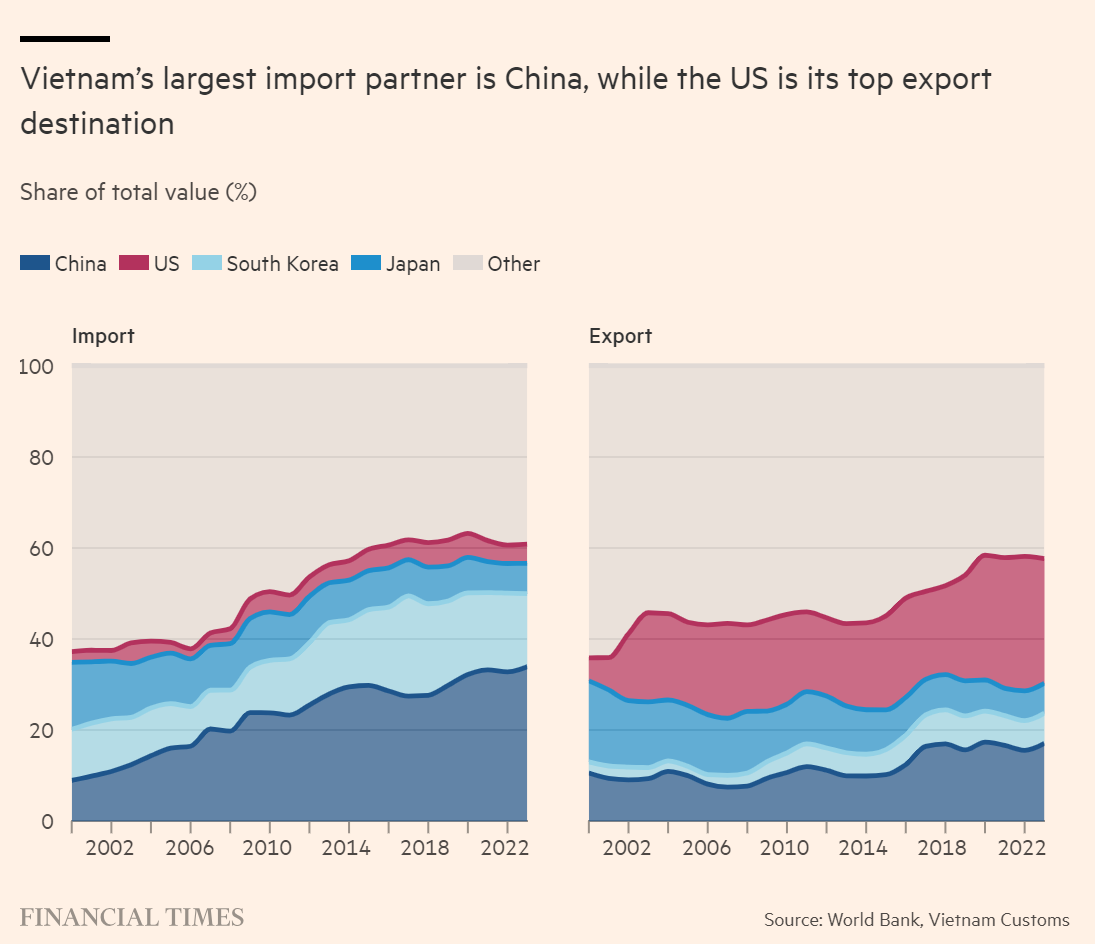

However, the success of the “China plus one” strategy has placed Vietnam in a vulnerable position. The country’s economy has become significantly reliant on the United States, which accounts for nearly 30 percent of its total exports. “Vietnam is now likely to face more stringent scrutiny, particularly for goods transiting through Vietnam to circumvent tariffs on China,” said Marco Förster, ASEAN Director at Dezan Shira & Associates in Ho Chi Minh City. Trump has pledged to impose a 60 percent trade tariff on imports from China and up to 20 percent on goods from all other countries. Economists at Singapore’s OCBC Bank have warned that Vietnam’s economic growth, which was 5 percent last year, could decline by as much as 4 percentage points under such measures. “If the trade tariffs were to be imposed on Vietnam, the consequences could be catastrophic,” Förster added.

Although Trump did not mention Vietnam during the recent presidential election campaign, he criticized the country in 2019 as “almost the single worst abuser of everybody.”

“Vietnam takes advantage of us even worse than China,” he told Fox Business. This has left businesses unsettled. “Certain Korean enterprises in Vietnam are concerned about potential trade tariffs from the new Trump administration,” said Hong Sun, chair of the Korea Chamber of Business in Vietnam. South Korea has long been one of Vietnam’s largest sources of foreign direct investment, with the electronics giant Samsung being the country’s single largest investor. If Washington imposes trade tariffs on Vietnamese goods, South Korean companies may delay or reduce their investments and production in Vietnam, Hong added. Vietnamese officials are acutely aware of the potential risks from Trump’s trade policies. At the Asia-Pacific Economic Cooperation summit in Peru last week, Vietnam’s President Luong Cuong issued a subtle warning, stating that “isolationism, protectionist policies, and trade wars only lead to economic recession, conflict, and poverty.”

“Now, more than ever, it’s critical to move beyond the ‘zero-sum game’ mindset and protect against nationalism distorting policy decisions,” he said.

While Southeast Asia as a whole benefited from the US-China trade war, no country has been as successful as Vietnam in attracting investment, thanks to its proximity to China, business-friendly policies, and incentives. Foreign investment reached $36.6 billion last year, while Vietnam’s trade surplus with the US surged to over $104 billion, nearly three times its $38 billion surplus in 2017 when Trump took office. Thailand ranks second in the region, with a US trade surplus of nearly $41 billion. The US-Vietnam relationship has strengthened since Trump left office. The two countries upgraded their ties last year to a “comprehensive strategic partnership,” the highest level of diplomatic relations offered by Hanoi. President Joe Biden referred to Vietnam as “a critical power in the world and a bellwether in this vital region,” and lifted the “currency manipulator” label that Trump had imposed.

Washington has also supported efforts to boost semiconductor production in Vietnam as part of its strategy to limit China’s access to advanced chipmaking. Experts have suggested that Vietnam could increase scrutiny of Chinese investments or initiate anti-dumping investigations to placate Trump, or take steps to reduce its trade surplus by purchasing military equipment, civilian aircraft, or liquefied natural gas from US companies. “The broader challenge is that Vietnam’s relatively small economy has limited capacity to increase imports from the US,” said Peter Mumford, Southeast Asia head for Eurasia Group. “In terms of foreign direct investment, Hanoi could modestly increase investment in the US, but this would do little to address Washington’s trade concerns.”

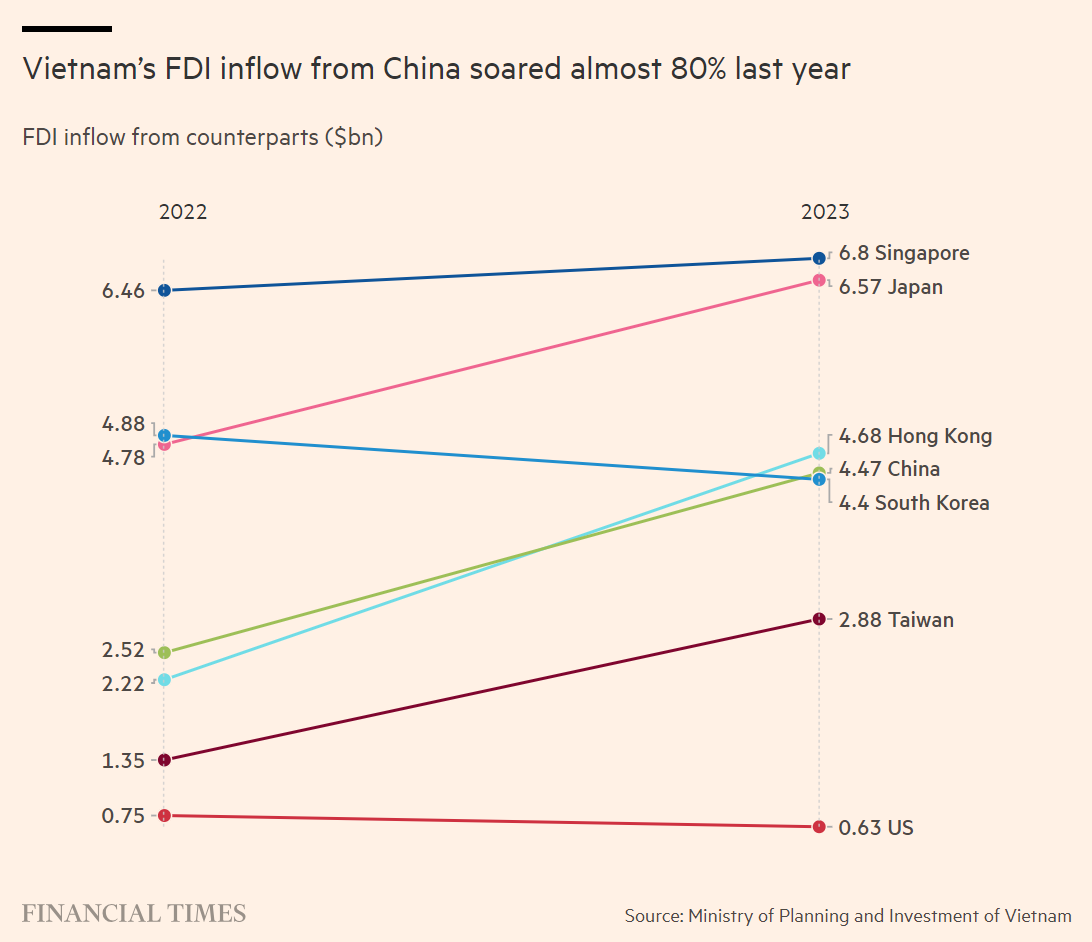

Vietnam’s foreign direct investment (FDI) inflow from China surged by nearly 80% last year.

Hanoi has fostered friendly relations with both Washington and Beijing under its non-aligned foreign policy, known as “bamboo diplomacy.” However, any increase in purchases from the US could potentially anger China, its largest trading partner and neighbor. Investments from China have also seen significant growth—along with broader FDI—rising by 80% in 2023. China accounted for the largest number of new projects in Vietnam this year. Förster pointed out that many Chinese goods were being routed through Vietnam “to circumvent trade tariffs, sometimes under questionable rules of origin or even fake ‘Made in Vietnam’ labels.”

He mentioned that Hanoi was working to implement stricter criteria for product labeling, a move that could help mitigate some of the incoming US administration’s discontent. Thuy Anh Nguyen, a director at Vietnam-focused asset manager Dragon Capital, stated that investments from Chinese companies might face increased scrutiny from Hanoi, but Vietnam would still continue to attract more FDI as manufacturers shift operations from China. Hanoi is “likely to proactively adjust import-export practices, negotiate trade agreements, and strengthen compliance with origin rules to reduce trade tariff risks,” she added. Additional reporting by Haohsiang Ko in Hong Kong. The first chart in this story, on the US trade deficit with Vietnam, has been revised since publication to correct the figures shown.

Source: Financial Times