Vietnam export to the US 2024 has experienced significant changes in the first half of the year, showing notable trends in export values, ports, importers, and exporters. Understanding these trends is essential for stakeholders in the furniture industry who are navigating this dynamic market.

Overview of Vietnam Export – HS9403 to the US 2024

The total export value of Vietnam export to the US 2024 reached remarkable numbers in the first half of the year:

- Quarter 1: $1,327,834,743

- Quarter 2: $1,052,346,295

These figures indicate a decrease in export value from Q1 to Q2, suggesting market fluctuations that exporters should be aware of. The report focuses on the HS Code 9403, which includes “Other furniture and parts thereof.”

Top Loading and Destination Ports

Vietnam’s furniture export to the US 2024 involved numerous ports:

- Loading Ports: 66 ports in Quarter 1 and 63 in Quarter 2

- Destination Ports: 381 ports in Quarter 1, dropping to 358 in Quarter 2

This data shows a slight reduction in the number of ports involved, potentially indicating changes in shipping routes or preferences.

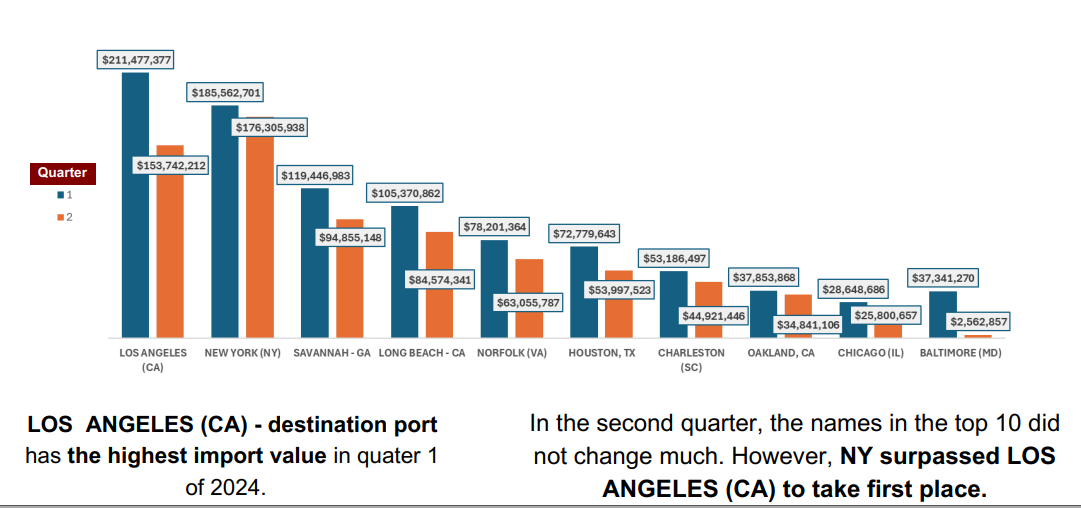

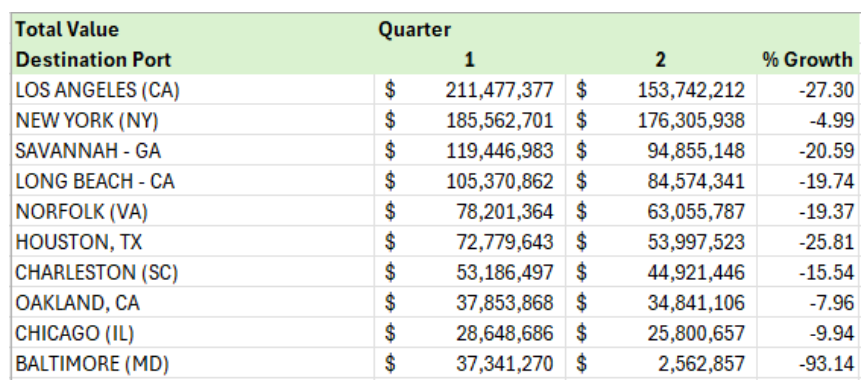

Top 10 Destination Ports for Vietnam Export to the US 2024

In the second quarter, New York (NY) emerged as the top destination port, surpassing Los Angeles (CA). However, in Quarter 1, Los Angeles (CA) was the primary destination port with the highest import value for Vietnam export to the US 2024.

These shifts highlight that the competitive landscape of destination ports is subject to change, and exporters should monitor these trends to maximize their efficiency.

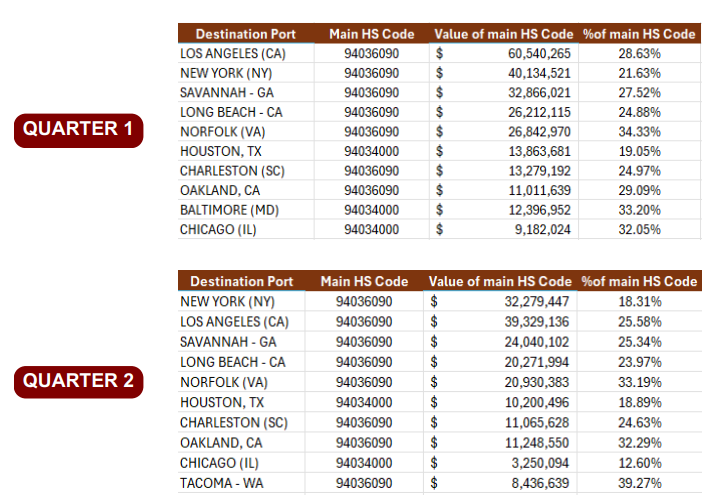

Main Imported Products by the Top US Ports

The primary products imported from Vietnam by the top 10 US ports were:

- HS Code 94036090: Other wooden furniture

- HS Code 94034000: Wooden furniture of a kind used in the kitchen

These two categories dominate the Vietnam furniture export to the US 2024, showing that wooden furniture, particularly kitchen-related products, is in high demand.

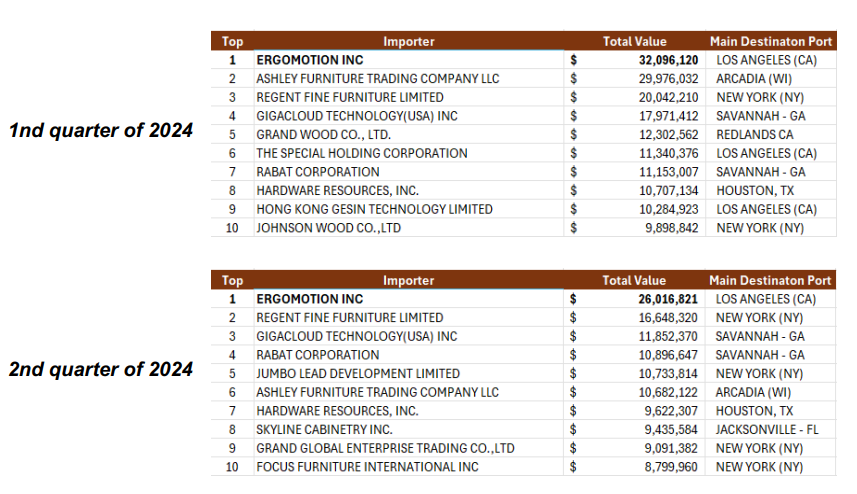

Top Importers and Exporters of Vietnam in 2024

ERGOMOTION INC was the largest importer in the US for both the first and second quarters of 2024.

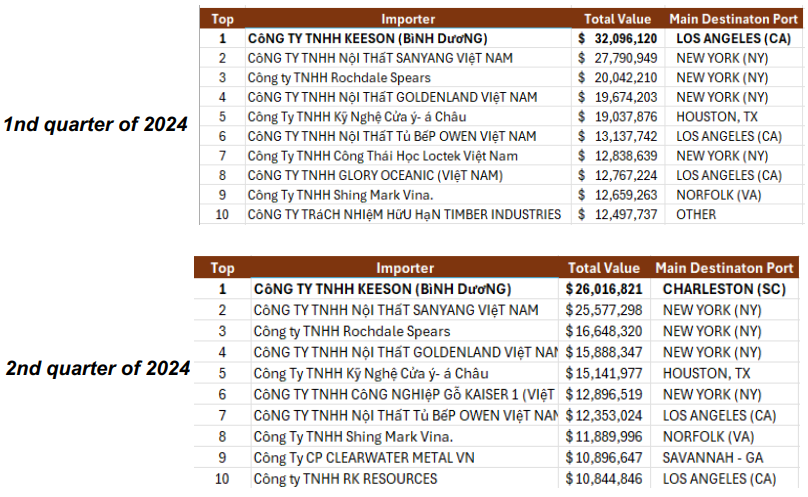

On the exporter side, KEESON COMPANY LIMITED (Binh Duong) emerged as the top exporter from Vietnam in the first six months.

This partnership between leading importers and exporters showcases a strong business relationship, emphasizing that quality and reliable supply chains are crucial for Vietnam export to the US 2024.

Growth of Import Value at US Ports

The growth of import value experienced a negative trend at several ports, with Baltimore (MD) showing the largest decline. This negative growth signifies that even popular ports can witness downturns, and businesses should adapt their strategies accordingly.

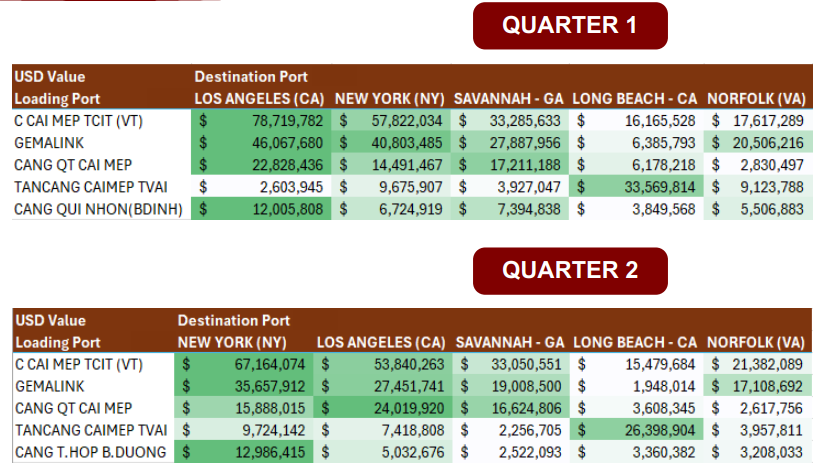

Top 5 Destination Ports in the US for Vietnam Export 2024

The Vietnamese loading port C CAI MEP TCIT (VT) stands out, having the highest export value to:

- Los Angeles (CA) in Quarter 1

- New York (NY) in Quarter 2

These trends reveal that while certain ports remain consistent, the leading destinations for Vietnam export to the US 2024 can shift within a short time frame.

Positive and Negative Trends in the Vietnam Export Market

Despite some negative trends in port growth, Vietnam export to the US 2024 maintains a positive trajectory in other areas, with several key ports and importers displaying resilience. The consistent demand for wooden furniture suggests that exporters can leverage this momentum by focusing on high-quality products that meet US market standards.

Final Thoughts: What’s Next for Vietnam Export to the US 2024?

The Vietnam furniture export to the US 2024 market is undergoing dynamic changes, with shifts in destination ports, importers, and export values. Staying informed about these trends, particularly the demand for HS Codes 94036090 and 94034000, will be crucial for businesses aiming to thrive in this competitive landscape.

Exporters should continue to monitor these trends, build strong relationships with leading importers like ERGOMOTION INC, and adapt to changes in port growth. The Vietnamese furniture industry has a robust presence in the US market, and by leveraging this insight, they can maintain and even expand their market share.

Conclusion

Understanding the trends in Vietnam furniture export to the US 2024 is vital for stakeholders, as it enables them to adapt to changes, seize opportunities, and maintain a competitive edge. By focusing on key products, monitoring port trends, and establishing strong partnerships, Vietnam’s furniture export industry can continue to flourish.

Read more detail about our report Here.

You can read more articles by visiting our blog here.