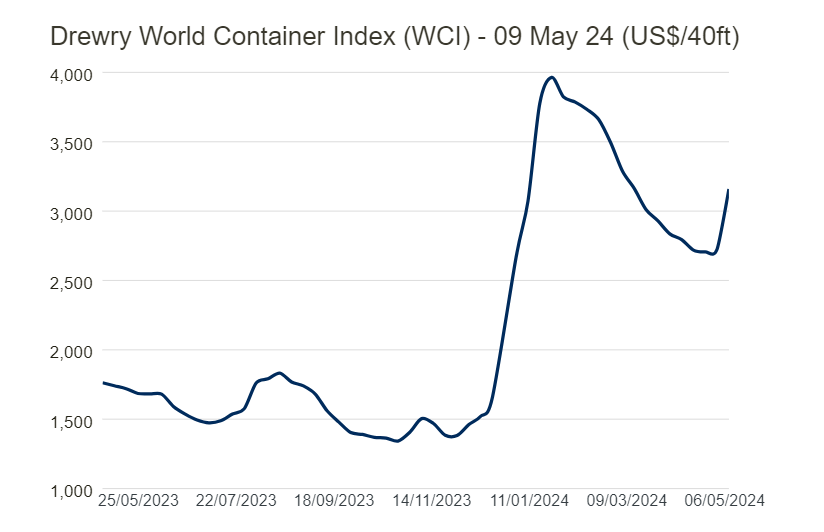

In the dynamic world of global trade, freight rates are a key indicator of market trends and economic shifts. This week, Drewry’s World Container Index (WCI) has captured significant attention with a notable 16% increase, reaching $3,159 per 40ft container. Let’s delve into the insights provided by this latest report and understand the implications for businesses worldwide.

The composite index, reflecting a comprehensive overview, has not only surged by 16% but has also seen a remarkable 81% increase compared to the same period last year. This underscores the substantial changes in the container shipping landscape, influenced by various factors including demand spikes, supply chain disruptions, and global economic dynamics.

One striking revelation from Drewry’s report is the staggering 122% increase compared to average pre-pandemic rates in 2019. This sharp rise, indicative of the ongoing market volatility, paints a vivid picture of the challenges faced by industry stakeholders in navigating the current environment.

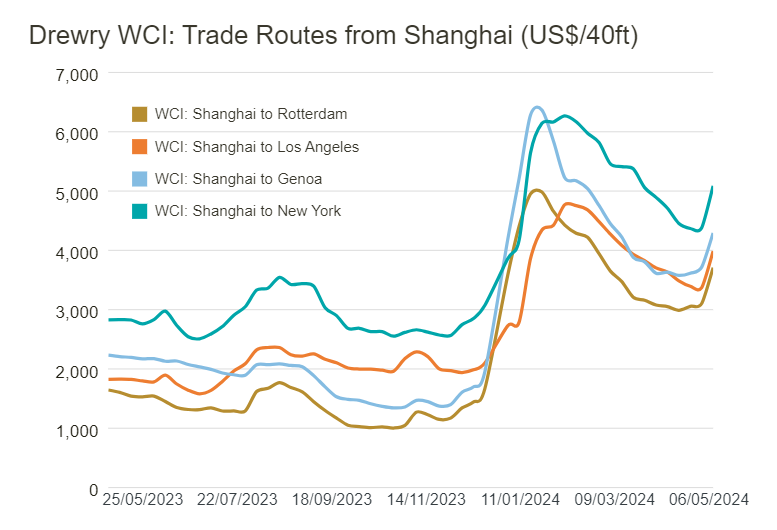

Analyzing specific trade routes provides further insights into the nuances of this trend. Freight rates from Shanghai to key destinations such as Rotterdam, Los Angeles, Genoa, and New York have witnessed significant hikes, reflecting the imbalance between supply and demand. For instance, rates from Shanghai to Rotterdam surged by 20%, reaching $3,709 per 40-foot container, while rates to Los Angeles increased by 18% to $3,988 per FEU.

Conversely, certain routes experienced minor fluctuations or declines in rates, highlighting the complex interplay of market forces. For instance, rates from New York to Rotterdam edged up by 1%, whereas rates from Rotterdam to New York decreased by 2%. Similarly, rates from Rotterdam to Shanghai declined by 6%.

Looking ahead, Drewry anticipates continued upward pressure on freight rates in China due to sustained demand and capacity constraints. This projection underscores the importance for businesses to adapt their supply chain strategies, explore alternative transportation options, and implement agile pricing mechanisms to mitigate cost impacts.

In conclusion, Drewry’s World Container Index report offers valuable insights into the evolving dynamics of global container shipping, highlighting the challenges and opportunities facing industry participants. By staying abreast of these developments and adopting proactive measures, businesses can navigate the complexities of the current market landscape and emerge resilient in the face of uncertainty.

Source: Drewry Freight Index