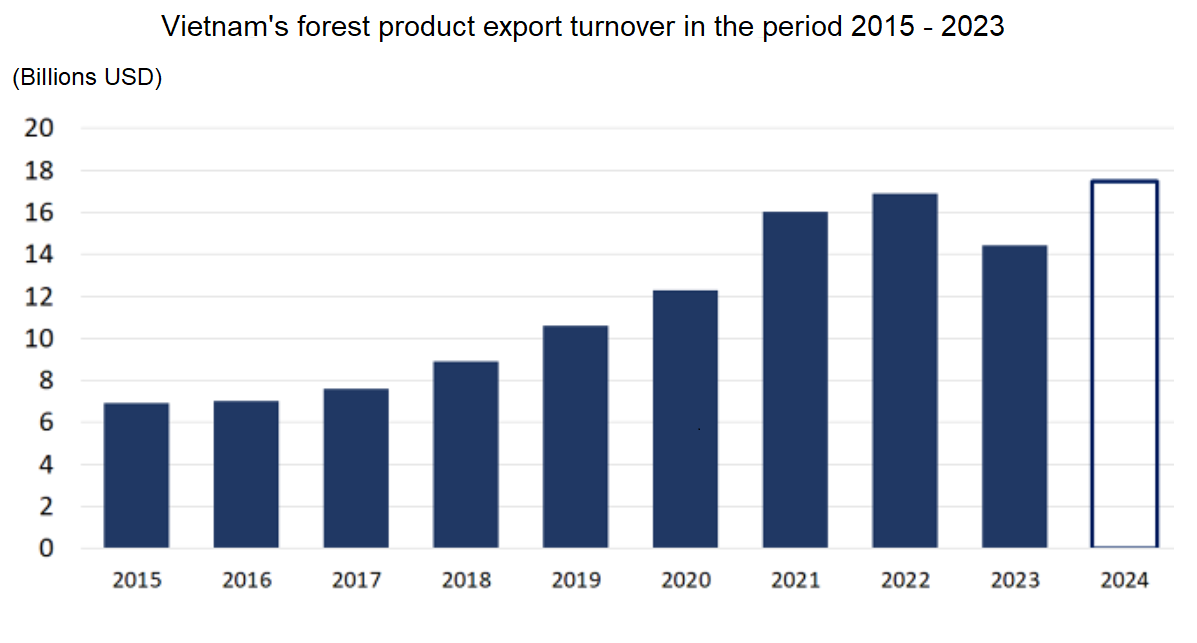

As we enter 2024, the forestry sector sets a target for export turnover to return to the 2022 peak of $17.5 billion USD in wood exports. Deputy Minister Nguyen Quoc Tri believes these targets are quite ambitious, especially amid prolonged and unpredictable political conflicts, presenting challenges for both export destinations and inputs.

In the year 2023, the wood industry set an ambitious export target of $17.5 billion USD.

However, by the end of December, the actual turnover had reached nearly $14.5 billion USD. This downward trend signals the need for a rapid restructuring of the industry, encompassing raw materials, products, and markets. Deputy Minister Nguyen Quoc Tri emphasized the necessity for a comprehensive review during the forestry sector’s year-end conference.

2023 proved to be a challenging year for the wood industry, with reduced demand in key export markets such as the U.S. and the EU. This led to a decline in orders, forcing many enterprises to scale back production and even close their doors.

Entering 2024, the forestry sector aims to revive export turnover to the 2022 peak, reaching $17.5 billion USD, a 21% increase compared to 2023. Deputy Minister Nguyen Quoc Tri acknowledges the high targets, especially amid prolonged and unpredictable political conflicts, posing difficulties for both export inputs and outputs.

According to industry associations and various enterprises, the outlook for the wood industry in 2024 remains uncertain. Mr. Do Xuan Lap, Chairman of the Vietnam Timber and Forest Product Association (Viforest), suggests that while there are signs of market recovery, potential risks persist.

“In 2024, the wood industry still faces considerable instability. Overall growth is slow, around 10–12% compared to the last quarter of 2023. The key solution in 2024 is to establish Vietnam’s wood industry as sustainable, based on certified wood usage and low-carbon emission products,” remarks Mr. Do Xuan Lap.

Apart from market challenges, the industry grapples with current affairs directly impacting its sustainability, such as the EU’s anti-deforestation regulations, low-carbon-emitting wood products, and risks associated with imported wood materials.

With market contraction and new regulations, 2024 may continue to be a challenging year for the wood industry.

Concerns about the wood export outlook are shared by Mr. Nguyen Liem, Chairman of Lam Viet Corporation, who notes that export prospects are unclear, with early 2024 orders received but factories not operating at full capacity.

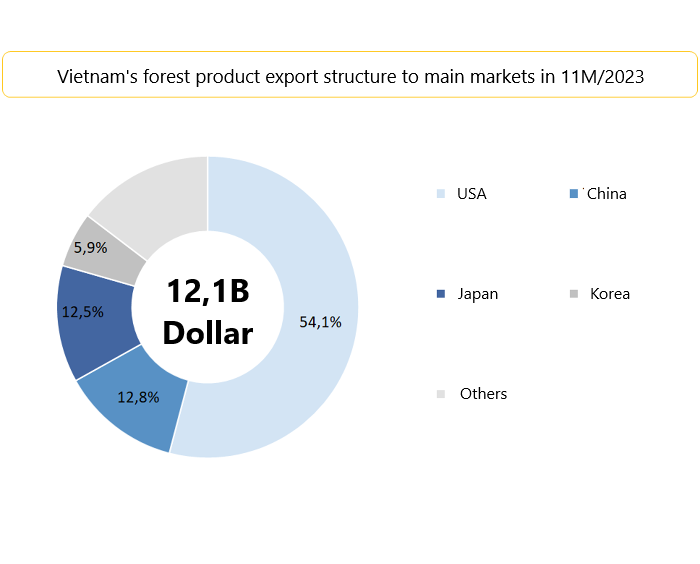

While challenges persist, the U.S. remains a strategic market for the wood industry.

After the U.S.-China trade tensions in 2018, Vietnam surpassed China, becoming the largest supplier of furniture to the U.S.

Mr. Ngo Sy Hoai, Vice Chairman and Secretary-General of Viforest, underscores the significance of the U.S. market, contributing approximately 50–55% to Vietnam’s total export turnover in forest products.

He highlights the advantage gained by the Vietnam wood industry due to ongoing U.S. anti-dumping and anti-subsidy duties on certain Chinese furniture items.

However, companies must remain vigilant about potential investigations into tax evasion on some wood products exported to the U.S. Despite signs of recovery, the size of orders may not reach previous levels, requiring additional time for the market to fully rebound.

In navigating the U.S. market, attention to legal environmental standards is crucial. Mr. Pham Quang Huy, Agriculture Counselor of Vietnam in the U.S., notes that inflation has eased in the U.S. market, and employment, especially in construction, is increasing. This suggests a potential resurgence in wood exports to the U.S.

On the flip side, inventory levels in the U.S. are projected to decrease by the end of 2023. This presents an opportunity for Vietnam to boost wood and wood product exports to the U.S. in the coming months.

While importers are gradually resuming purchases, the size of orders is not as substantial as before. Market recovery and overcoming pandemic-related challenges will require additional time.

Mr. Pham Quang Huy emphasizes the U.S. legal environment, requiring imported wood products to meet environmental protection, safety, revenue, and fair trade criteria.

He advises companies to comply with Decree 102 on Vietnam’s legal timber system and the 301 Agreement between the two countries on logging and trade in illegal timber.

To address challenges and enhance competitiveness, businesses should improve management systems, increase accountability, use intelligent accounting software for transparent input-output information, and monitor trade-related incidents within the industry.

In conclusion, the wood industry faces a complex landscape in 2024, balancing market uncertainties, regulatory challenges, and the imperative for sustainable development.”