For many years, Vietnam has welcomed major multinational corporations such as Apple, Samsung, and Intel, establishing itself as a key player in the global manufacturing sector. Today, the country is positioned to expand its economic influence even further.

President-elect Donald Trump has asserted that his strategy to impose significant tariffs on imported goods will reduce the U.S. federal deficit, lower food prices, and generate additional employment opportunities domestically.

During his campaign in Savannah, Georgia, he promised to “relocate entire industries” back to the United States, claiming that manufacturing would shift from China to Pennsylvania, from Korea to North Carolina, and from Germany to Georgia.

However, such reshoring appears unlikely to materialize—at least not on the scale or timeline that Trump envisions, if it happens at all. Instead, it is anticipated that Vietnam will emerge as a key beneficiary of these trade policies. As Jason Miller, a supply chain management professor at Michigan State University, explained to Forbes, “If it was made in China before, it will now be made in Vietnam.” He emphasized that this production will not be returning to the U.S. anytime soon.

During the previous Trump administration, several major foreign corporations, including Apple, Foxconn, and Intel, began shifting their manufacturing operations to Vietnam as part of a strategy to diversify their production portfolios. Just two months ago, SpaceX also announced a $1.5 billion investment in the country. Even the Trump Organization has entered the Vietnamese market, with a newly publicized $1.5 billion luxury real estate deal.

Today, Vietnam is strategically positioned to capitalize further on the anticipated anti-China sentiment under the incoming administration. This is especially true if the country acts swiftly to streamline its regulatory environment, enabling businesses to establish operations with greater ease.

Vietnam possesses several key advantages over its regional competitors, such as India. As a single-party, authoritarian state, Vietnam has the ability to rapidly implement business-friendly policies. Geographically, the country is ideally situated: it is home to three of the world’s 50 busiest ports and shares a border with China, facilitating trade and logistics between the two nations. Furthermore, Vietnam has secured a free trade agreement with the European Union—making it the only other country in the region, besides Singapore, to do so. (India is currently in negotiations for a similar agreement, which would help facilitate smoother trade between the EU and the world’s most populous country.)

Vietnam is making swift progress in enhancing its infrastructure to support large-scale projects. A key example is a new decree introduced earlier this year, allowing companies to directly purchase green energy from solar power producers, bypassing the traditional state-run utility system. This initiative, which facilitates companies in meeting their climate targets, has been praised by major foreign investors, including Apple and Samsung, as well as the U.S. Embassy in Hanoi.

In recent months, President-elect Donald Trump has reiterated his commitment to promoting American manufacturing and increasing the cost of foreign-made goods imported into the United States. He has specifically targeted Mexico and China, stating earlier this month that he would impose tariffs ranging from 25% to 100% on products manufactured south of the U.S.-Mexico border.

This marks a significant departure from Vietnam’s origins as a manufacturing hub in Southeast Asia. In the 1990s, the country gained recognition for producing footwear and textiles for major multinational corporations such as Nike and Adidas. However, by the 2000s, large electronics companies began relocating their production from China to Vietnam to capitalize on lower labor costs and favorable trade agreements. Samsung opened its first manufacturing facility in Vietnam in 2008, followed by other multinational giants, including LG and Intel. This influx of multi-billion-dollar deals led smaller suppliers to establish operations in Vietnam as well.

As a consequence, Vietnam’s trade deficit with the United States—the gap between its exports and imports—has tripled since 2004. According to the U.S. Census Bureau, Vietnam now ranks as the fourth-largest trade deficit partner with the United States, following China, Mexico, and the European Union.

When the first Trump administration imposed tariffs on specific goods made in China, like solar panels and washing machines, in 2018, they did not entice firms to bring manufacturing home. Instead, production just shifted to Vietnam, as well as other Asian nations, including Thailand, Malaysia, and India. But Vietnam’s GDP has grown faster than any of its Asian neighbors except for China, averaging 6.2% growth per year.

By May 2020, Apple began moving manufacturing AirPods out of China and into Vietnam. Months later, Foxconn reportedly began moving some of its iPad and MacBook assembly out of China and to Vietnam at Apple’s request. (Apple has also moved some production to India.)

Statistics from the United States International Trade Commission also show that between 2018 and 2019, electronics imports from Vietnam almost doubled. A 2023 report from the World Bank found that between 2017 and 2022, the amount of Chinese-made items ranging from sewing machines to laser printers imported into the U.S. fell, while the share of Vietnamese-made items rose at corresponding rates.

Vietnam has undeniably seized the opportunity presented by the U.S.-China trade tensions. As noted by Pablo Fajgelbaum, an economics professor at the University of California, Los Angeles, Vietnam is “one of the countries that managed to take advantage of the U.S.-China tariffs, in terms of being able to enter the U.S., at least over the first few years of the trade war,” according to an interview with Forbes.

This shift has significantly expanded Vietnam’s export economy, as factories relocated to the country to produce goods for markets beyond just the U.S. “Vietnam has grown its exports to the rest of the world as well,” Fajgelbaum observed. He further predicts that if a tariff gap remains between Vietnam and China, companies will continue to move their production facilities to Vietnam.

In line with this trend, Maersk recently announced the opening of its first bonded warehouse in northern Vietnam, located in the Haiphong seaport region. This facility will allow goods to be stored before paying duties or tariffs, with Amazon Vietnam named as its first client. Additionally, Lego, the renowned Danish toy manufacturer, revealed that its new $1 billion manufacturing plant in Binh Duong is nearing completion, with plans to begin operations in early 2025.

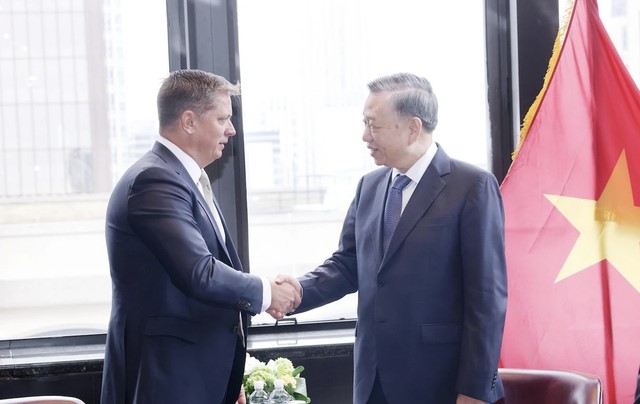

Vietnam has also cultivated closer ties with Donald Trump and his family. In early October, Eric Trump, the son of the president-elect and executive vice president of the Trump Organization, announced the launch of a $1.5 billion development project in a province near Hanoi. The project will include five-star hotels and golf courses.

“Vietnam holds immense potential in the realm of luxury hospitality and entertainment, and we are extremely excited to collaborate with this remarkable family to redefine luxury in the region,” said Eric Trump in a statement at the time, referring to the company’s Vietnamese partners.

Domestic investors in Vietnam also see significant opportunities arising from these trends. Michael Kokalari, the chief economist at VinaCapital, one of the largest investment firms in the country with $3.7 billion in assets under management, shared with Forbes that these developments will generate increased demand for logistics and clean energy companies, while also contributing to the growth of Vietnam’s middle class. “A substantial portion of our investment activities at VinaCapital focuses on companies that either directly or indirectly benefit from the expanding middle class,” he stated in an email.

Just as companies once shifted manufacturing to China, Trump’s tariffs are expected to accelerate this movement toward Vietnam. In any case, the opportunity has already been seized domestically.

Source: Cyrus Farivar (Forbes)