A comprehensive overview of Vietnam’s wood and wood products (W&WP) import performance in 2023 reveals dynamic market shifts. Factors such as slowing export turnover and a subdued domestic real estate market influenced a decline in W&WP import turnover. The first 15 days of December 2023 saw a marginal dip. Foreign Direct Investment (FDI) enterprises played a crucial role, though their cumulative import turnover showed a decline. Noteworthy is the fluctuating import landscape from major supply markets, with China maintaining significance despite an overall decline. The French market stands out with a slight increase.

IMPORT TURNOVER:

As per the initial data provided by the General Department of Vietnam Customs, the import turnover for wood and wood products (W&WP) entering Vietnam in November 2023 surged to almost US$202 million, marking a notable 13.6% increase from the previous month. However, the cumulative W&WP import turnover for the first 11 months of 2023 in Vietnam amounted to US$1.98 billion, indicating a substantial 29.6% decrease compared to the corresponding period in 2022.

The decline in W&WP import turnover is primarily attributed to a deceleration in export activities and the sluggishness observed in the domestic real estate market. Over the initial 11 months of 2023, Vietnam recorded a trade surplus of US$10.138 billion in W&WP import and export, marking a decrease from the trade surplus of US$11.86 billion during the corresponding period last year.

During the initial 15 days of December 2023, the import turnover for wood and wood products (W&WP) into Vietnam amounted to US$103 million, experiencing a slight decrease compared to the corresponding period in November 2023.

Foreign Direct Investment (FDI) Enterprises:

In November 2023, the import turnover for wood and wood products (W&WP) by FDI enterprises reached almost US$68 million, displaying an 8.67% increase compared to October 2023 and a substantial 13.51% growth over the same period last year. Over the initial 11 months of 2023, the W&WP import turnover by FDI enterprises amounted to nearly US$680 million, witnessing a 27.9% decrease from the corresponding period last year. This accounted for 34.27% of the total import turnover of W&WP in the entire industry.

Over the initial 11 months of 2023, Foreign Direct Investment (FDI) enterprises maintained a trade surplus of US$4.85 billion in the import and export of wood and wood products (W&WP), indicating a decrease from the trade surplus of US$5.877 billion in the same period last year.

Import Market Dynamics:

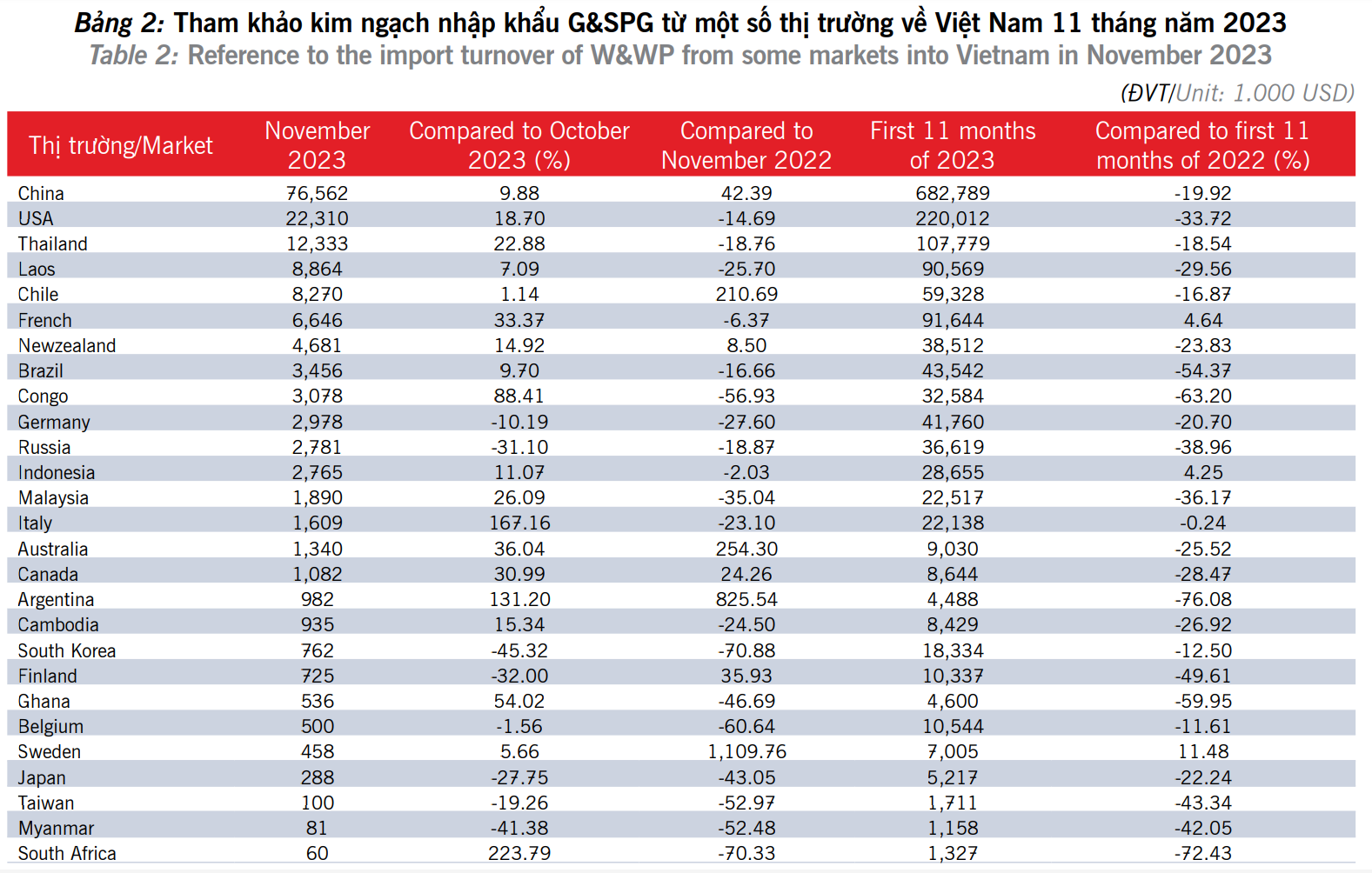

In November 2023, the import turnover for wood and wood products (W&WP) from most major supply markets demonstrated significant growth. Comparing to the previous month, there was a robust increase: China surged by 9.88%, the United States rose by 18.7%, Thailand saw a notable increase of 22.88%, France experienced a substantial growth of 33.37%, and Congo exhibited a remarkable surge of 88.41%.

Supply Market Overview:

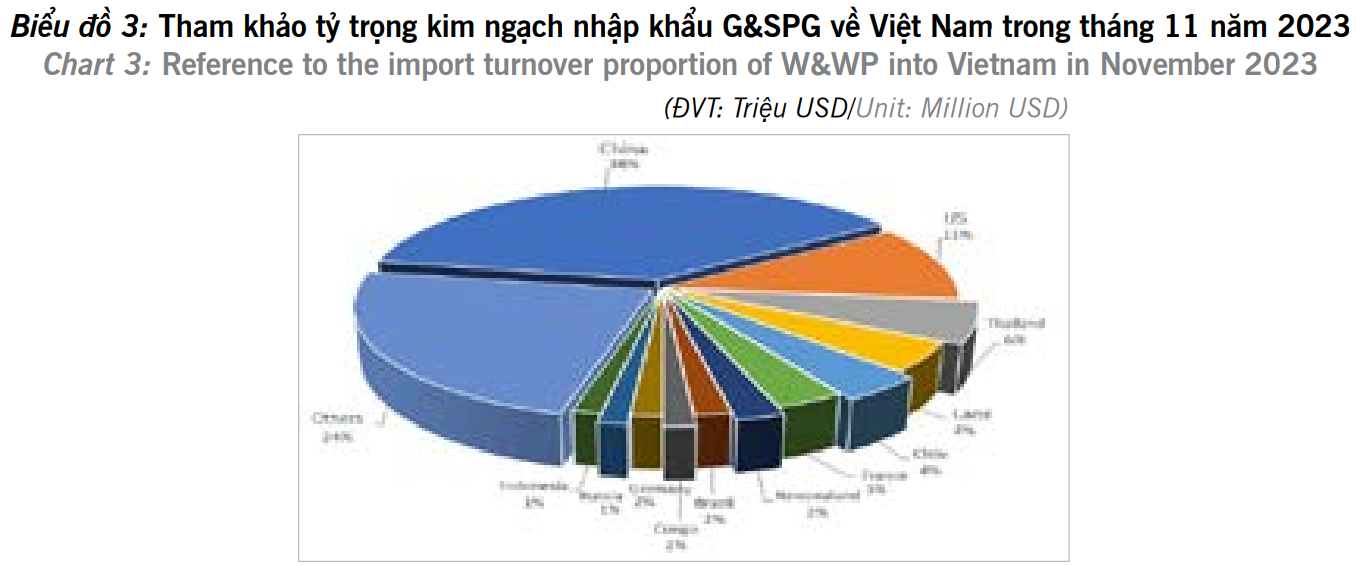

Throughout the initial 11 months of 2023, despite a 19.92% decline compared to the same period last year, China retained its position as the foremost supply market for wood and wood products (W&WP) in Vietnam, amounting to US$682 million. This constituted 34% of the total W&WP import turnover in the country. However, W&WP import turnover from most major markets witnessed a significant decrease compared to the same period last year, with only the French market showing a slight increase of 4.64%.

Source: Goviet.org.vn

See more about: Vietnam’s export situation of wood and wood products in the first 11 months of 2023