The assaults by Houthi rebels, contributing to Red Sea instability, on cargo vessels traversing the Red Sea are creating disruptions in worldwide trade activities. The likelihood of an upsurge in prices for goods and fuel looms as trade experiences ongoing disturbances.

As reported by CNBC, numerous major shipping and oil transport firms have temporarily suspended their operations in the Red Sea. This decision follows a series of attacks by Houthi rebels, backed by Iran, on over a dozen cargo ships since the onset of the conflict between Israel and Hamas in October.

Companies such as Hapag Lloyd, Yang Ming Marine Transport, MSC, CMA CGM, Maersk, and Evergreen have swiftly adjusted their schedules to reroute shipments, prioritizing the safety of both sailors and cargo. Together, these shipping giants account for approximately 60% of global trade.

In addition, Evergreen declared its temporary suspension of cargo acceptance bound for Israel, while Orient Overseas Container Line (OOCL), affiliated with the COSCO Shipping Group in China, has similarly halted cargo acceptance for Israel, citing operational disturbances.

On December 18th, BP, the British oil titan, made public its decision to temporarily cease energy transportation activities through the Red Sea due to the persistent attacks by Houthi forces. Concurrently, the oil tanker company Frontline is steering clear of the Red Sea amidst the current circumstances.

The leading oil corporation announced that the safety of our sailors and all associated personnel is prioritized by BP. A temporary halt on all shipping journeys through the Red Sea has been chosen by BP, given the escalating maritime security concerns.

Not only that, Yoni Essakov, an executive committee member of the Israel Shipping Association, revealed in a conversation with CNBC that roughly a third of our nation’s imports are transported via the Red Sea on container vessels reserved two to three months ahead of time.

Mr. Essakov emphasized that, due to the ongoing instability, importers are compelled to boost their inventory levels, resulting in increased procurement costs. Certain enterprises may encounter challenges as the competitiveness of their goods in the market diminishes.

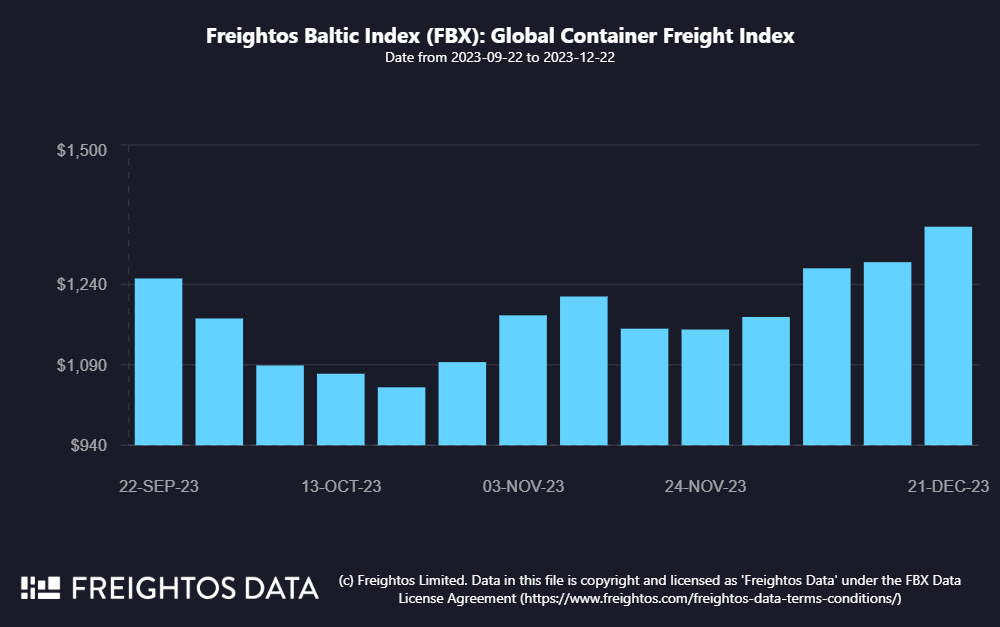

Freight charges have increased.

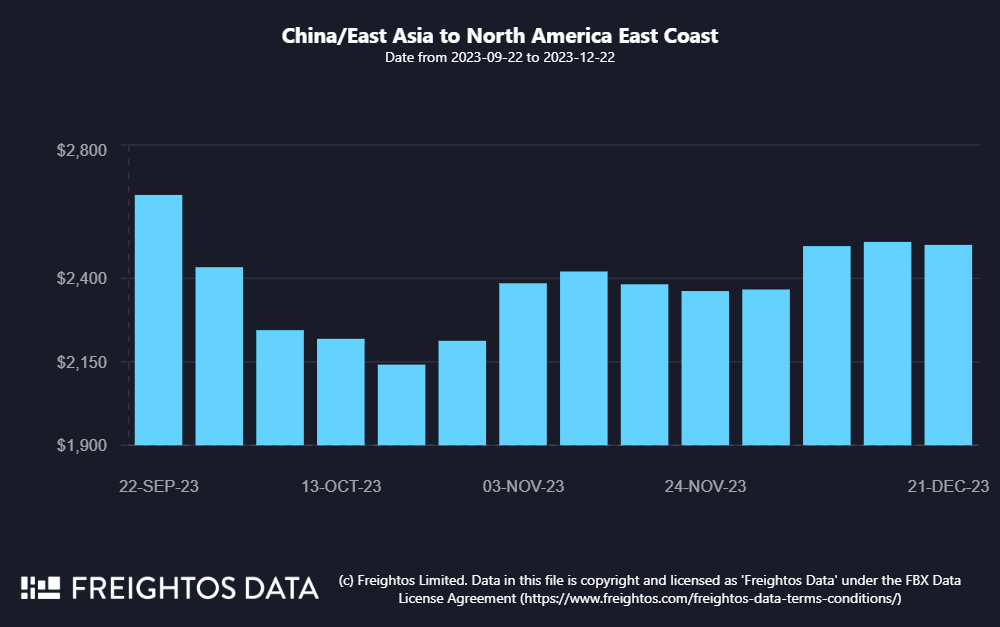

The Houthi attacks have led to an increase in shipping costs. Since the onset of hostilities between Israel and Hamas, freight rates from Asia to the U.S. East Coast have surged by 5%, reaching around $2,497 per 40-foot container, as reported by Freightos.

Projections from CNBC suggest that freight rates could see further hikes as major businesses opt to bypass the Suez Canal, choosing the longer route around the Cape of Good Hope through the Indian Ocean.

Choosing the longer route adds an extra 14 days to the travel time for ships, resulting in elevated fuel expenses. Additionally, the circumnavigation solution is likely to curtail shipping capacity due to extended delivery times, causing inevitable delays in the transportation of container ships and goods.

As stated by Michael Aldwell, a high-ranking executive at Kuehne+Nagel, roughly one-third of the entire global transportation system is comprised of the shipment of goods via container vessels. The approximate value of these transported goods is estimated to be around 1 trillion USD.

According to Mr. Aldwell, the Suez Canal witnesses around 19,000 ship passages each year. Expectations point to a 20% decline in shipping capacity during Suez-related blockages, potentially causing interruptions in cargo transport operations and a considerable decrease in available vessels.

Additionally, the Deputy Director at Kuehne+Nagel emphasized that returning empty containers to Asia might experience delays, exacerbating the complexities within the supply chain.

Moody’s has alerted clients to the potential for delays in communication. Senior analyst Daniel Harlid at Moody’s warned, “Should this situation persist beyond a few days, the likelihood of supply chain disruptions will escalate.”

In response, cargo insurance firms are modifying their policies, which may lead to additional costs for both shipping companies and consumers. CNBC reports that the Joint War Committee, including representatives from London-based maritime insurance companies, has disclosed an expansion of the high-risk zone from 15 degrees North to 18 degrees North.

Additionally, redirecting cargo ships may pose a potential threat to Egypt’s already struggling economy. The nation has suffered significant setbacks in its tourism industry due to the ongoing Israel-Hamas conflict.

As of now, Egypt possesses, operates, and oversees the Suez Canal. The canal’s management authority has disclosed that the Suez Canal achieved a record revenue of $9.4 billion in the fiscal year 2022-2023.

In a separate development, it seems that the military forces of various nations are escalating their endeavors to safeguard the Red Sea region. U.S. Secretary of Defense Lloyd Austin revealed that a new force, comprising U.S. troops along with personnel from the United Kingdom, Bahrain, Canada, France, Italy, the Netherlands, Norway, the Seychelles, and Spain, is being established to ensure the protection of ships in the area.

Source: doanhnghiepkinhdoanh.doanhnhanvn.vn