In the context of shipping companies redirecting away from the Red Sea due to concerns about Houthi rebel attacks, logistics managers are facing two simultaneous cargo challenges.

As cargo vessels steer clear of the Red Sea amidst concerns about potential attacks by Houthi rebels, there is a surge in both maritime and aerial freight rates. This has led to the significant stranding of goods valued at hundreds of billions of USD. These dual challenges present imminent risks to the worldwide supply chain and the potential for inflation.

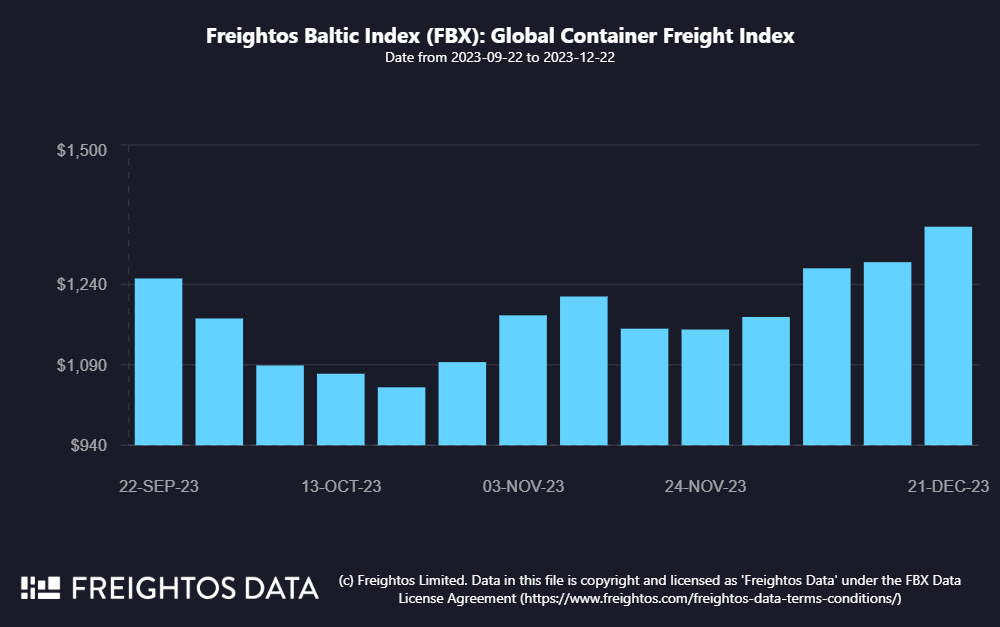

Freight shipping rates are experiencing a notable increase.

On December 21, there was a sudden surge in shipping freight rates within a short span. As reported by CNBC, logistics managers received notifications that the freight rate for a 40-foot container from Shanghai to the UK had climbed to $10,000.

In the previous week, rates stood at $1,900 for a 20-foot container and $2,400 for a 40-foot container. Additionally, trucking costs in the Middle East have doubled compared to the previous week.

While U.S. shippers have various sea route alternatives, European businesses face limitations due to their heavy reliance on the Suez Canal. The redirection of cargo ships to Europe takes more time, prompting businesses in the region to increasingly opt for air transportation for their products.

Judah Levin, Head of Research at Freightos, highlighted a significant decrease in daily freight rates based on the Freightos Air Index since late November. However, the recent shift to air transportation has led to a resurgence in prices, with air freight rates increasing by 13% this week, moving from $3.95/kg to $4.45/kg.

158 vessels have departed from the Red Sea, carrying commodities valued at 105 billion USD.

Kuehne + Nagel, an international logistics company, informed CNBC that as of the morning of December 21, 158 ships had altered their course away from the Red Sea. These ships transported over 2.1 million containers of goods, estimated by MDS Transmodal to be worth approximately 105 billion USD.

Currently, there are no indications that Houthi attacks will come to a halt.

IKEA, along with other businesses, has issued a caution that redirecting ships will impact the availability of the company’s goods.

In response to CNBC, IKEA mentioned that they are collaborating with transportation partners to manage orders and ensure the safety of their workforce in the supply chain. The spokesperson for IKEA stated, “What we can share now is that the situation at the Suez Canal will cause delays and constraints on the supply of some of the company’s products.”

Stranded goods management alternatives

CEOs within the logistics sector report that they are systematically classifying stranded goods. Specifically, in the context of Europe or the Middle East, they are actively exploring strategies to transport a curated selection of products through air freight. Concurrently, U.S. shippers are contemplating alternative trade routes, including trans-Pacific options to the West Coast and even considerations involving the Panama Canal. Their evaluations primarily consider factors such as time efficiency and shipping costs.

Additionally, potential alternatives in the Middle East encompass ports like Dubai and Aqaba. As noted by CNBC, for goods located at ports inaccessible to cargo planes, smaller transfer vessels will play a crucial role in retrieving and delivering goods to larger ports. At these larger ports, containers will be loaded onto vessels with greater capacity, ensuring continuity on an extended sea journey.

Inflationary Concerns

The sudden surge in shipping freight rates and its potential impact on inflation hinge on the time required for ships to redirect and the duration during which ship owners must bear elevated transportation expenses.

CEOs within the logistics sector assert that if the bottleneck persists for a month, both the global supply chain and consumers on a worldwide scale will start to experience the effects of inflation. Members of the American Apparel and Footwear Association (AAFA) in the retail sector are vigilantly monitoring developments in the Red Sea. They are urging the government to promptly initiate a comprehensive “Operation Prosperity Guardian” campaign to secure the safety of this crucial maritime route.

Steve Lamar, CEO of AAFA, emphasizes, “98% of our apparel is imported from abroad. Thus, maintaining secure and cost-effective transportation operations is imperative for us. Members have had to reroute goods and are grappling with additional charges.” The CEO highlights the Suez Canal incident, underscoring that any disruption in this pivotal trade gateway promptly impacts transportation costs and the prices of commodities.

Source: doanhnghiepkinhdoanh.doanhnhanvn.vn