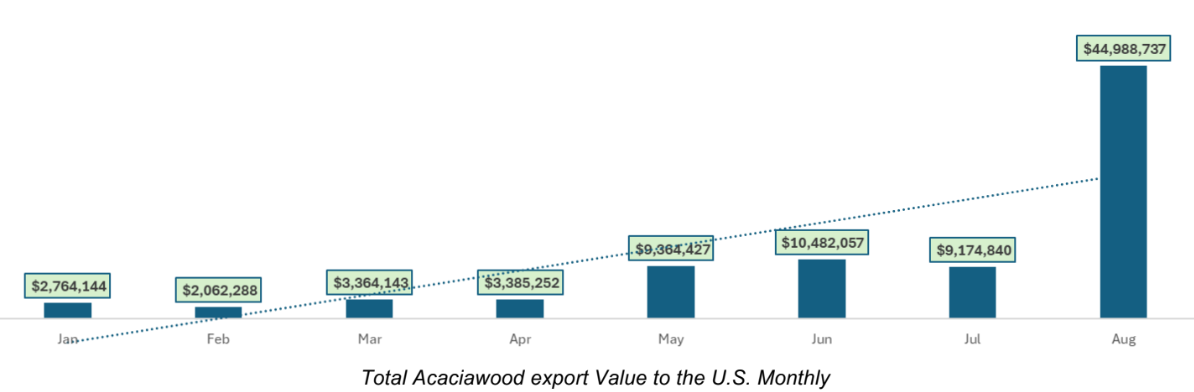

Vietnam’s Acacia wood export under HS9403 – Other furniture and parts thereof has seen remarkable growth from January to August 2024, reaching a total export value of $85,585,887. This surge involves 243 Vietnamese exporters and 362 importers, highlighting a robust international trade network.

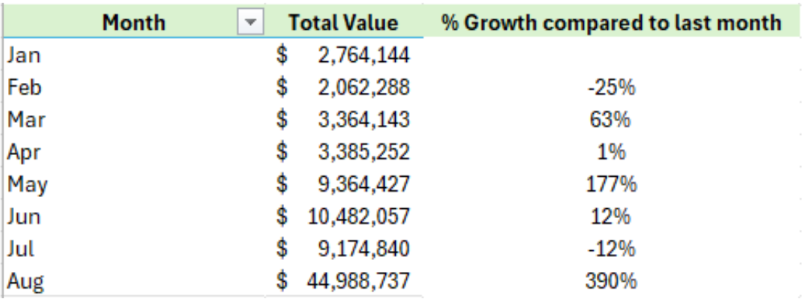

Overview of Export Growth

The export value of Acacia wood from Vietnam to the U.S. shows a significant upward trend. August marked an extraordinary peak with exports valued at $44,988,737, a 390% increase compared to previous months.

- January to February: 25% decline, indicating a challenging month.

- February to March: 63% recovery, showing resilience.

- May: 177% surge, demonstrating a strong comeback.

- August: 390% peak growth, highlighting the industry’s potential.

This volatility underscores both the challenges and resilience of the industry.

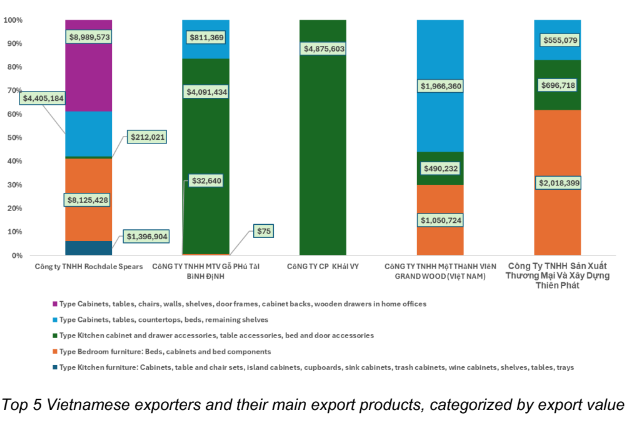

Key Players in the Export Market

Leading Vietnamese Exporters

- Rochdale Spears Limited

- Thien Phat Construction Company Limited

- Phu Tai Binh Dinh Wood Company Limited.

- Khai Vy Joint Stock Company.

- Grandwood (Vietnam) Company Limited.

Each company exports a mix of products, contributing to the overall export value and showcasing the diverse offerings of Vietnam’s wood industry. Rochdale Spears Limited stands out as the leading exporter, known for its high-quality wood components and construction materials.

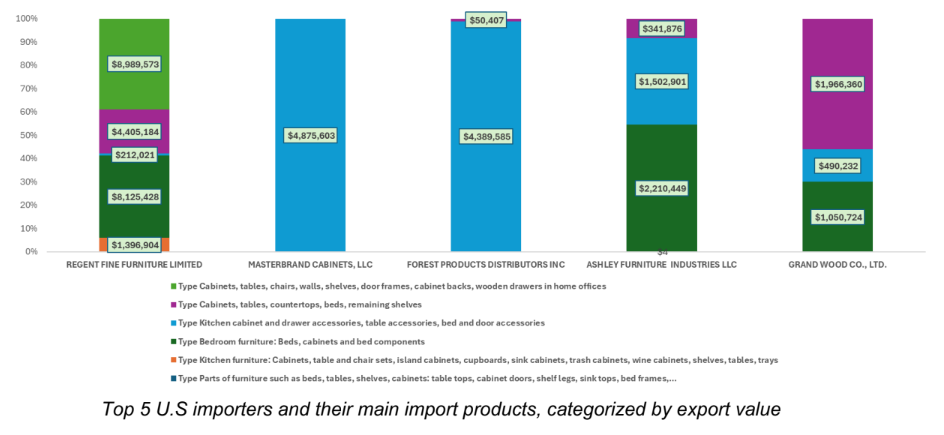

Leading U.S. Importers

- Regent Fine Furniture Limited

- Masterbrand Cabinets LLC.

- FPD INC.

- Ashley Furniture Industries LLC.

- Grand Wood CO., LTD.

These importers are instrumental in bringing Vietnamese Acacia wood into the U.S. market, each with a specific focus on different furniture and wood products. Regent Fine Furniture Limited leads in various categories, highlighting its significant market presence.

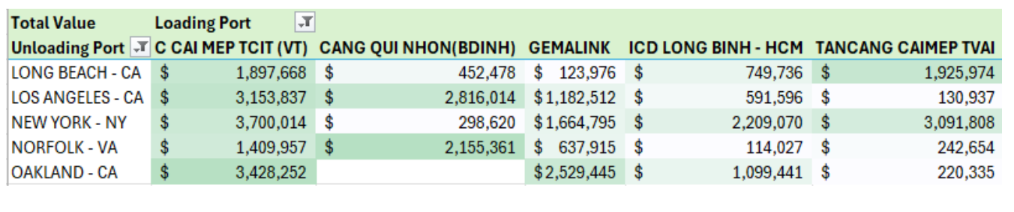

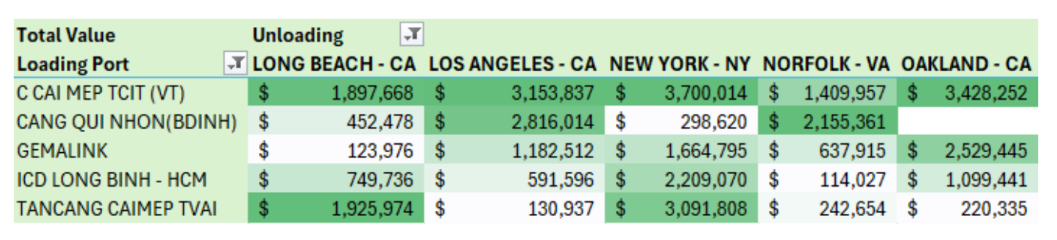

Strategic Loading and Unloading Ports

Top Loading Ports in Vietnam

These ports play a crucial role in facilitating the export process, ensuring efficient logistics and transportation of Acacia wood products.

Top Unloading Ports in the USA

This strategic distribution emphasizes the importance of multiple unloading ports across the U.S., ensuring broad market access and diversification.

Detailed Monthly Export Analysis

The monthly export data reveals significant fluctuations, which can be attributed to various market dynamics and external factors.

- January: The year began with steady export values.

- February: A 25% decline due to market adjustments and seasonal factors.

- March: A 63% recovery as market conditions improved.

- April: Stabilization in export values.

- May: A significant 177% surge, driven by increased demand and favorable trade conditions.

- June: Continued growth, maintaining momentum.

- July: Slight fluctuations but overall positive trend.

- August: A peak growth of 390%, reaching an export value of $44,988,737, showcasing the industry’s potential and resilience.

Market Dynamics and Challenges

The Acacia wood export market faces several challenges, including fluctuating demand, seasonal variations, and global economic conditions. However, the industry has shown remarkable resilience, bouncing back from declines and capitalizing on growth opportunities.

- Supply Chain Disruptions: Weather events and logistical challenges can impact the supply chain, causing delays and affecting export values.

- Trade Policies: Changes in trade policies and tariffs can influence market dynamics, affecting the competitiveness of Vietnamese Acacia wood in the global market.

- Sustainability Concerns: Increasing focus on sustainable practices and certifications can impact the market, with consumers and businesses prioritizing environmentally-friendly products.

Future Prospects

The future of Vietnam’s Acacia wood export market looks promising, with several growth opportunities on the horizon:

- Market Expansion: Exploring new markets and diversifying export destinations can help mitigate risks and enhance growth.

- Product Innovation: Developing new products and improving the quality of existing offerings can attract more buyers and increase export values.

- Sustainability Initiatives: Emphasizing sustainable practices and obtaining certifications can enhance the market appeal of Vietnamese Acacia wood.

Conclusion

Vietnam’s Acacia wood export market has shown dynamic growth with significant monthly fluctuations. Leading exporters and importers, along with strategic loading and unloading ports, have played crucial roles in this success. The upward trend and strategic diversification underscore the resilience and potential of Vietnam’s Acacia wood export industry.

The market faces challenges, but with strategic initiatives and a focus on sustainability, Vietnam’s Acacia wood export industry is poised for continued growth and success. By leveraging market opportunities and addressing challenges, Vietnam can further solidify its position as a leading exporter of Acacia wood in the global market.

Read more detail about our report Here.

You can read more articles by visiting our blog here.