In the fast-paced world of global trade, staying abreast of container freight rates is essential for businesses navigating the complexities of logistics. This week, Drewry’s World Container Index presents a nuanced picture, reflecting both short-term fluctuations and long-term trends in the shipping industry.

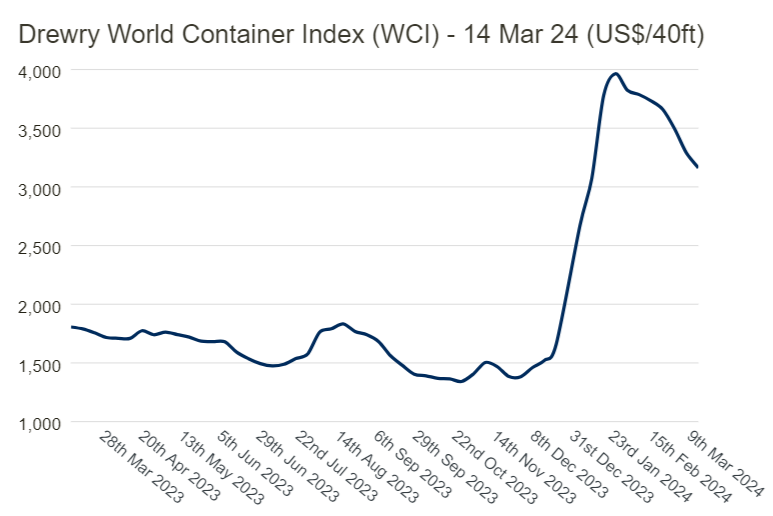

According to Drewry’s latest assessment on Thursday, March 14, 2024, the composite index witnessed a 4% decrease to $3,162 per 40-foot container compared to the previous week. However, it’s important to note that this figure represents a substantial 77% increase compared to the same week last year, showcasing the dynamic nature of market forces.

Delving deeper into the numbers, the current composite index stands at $3,162 per 40-foot container, marking a significant 123% surge compared to the average rates recorded in 2019, before the onset of the pandemic. This upward trajectory is indicative of the evolving landscape of global shipping, influenced by a myriad of factors including supply chain disruptions, geopolitical tensions, and fluctuating demand patterns.

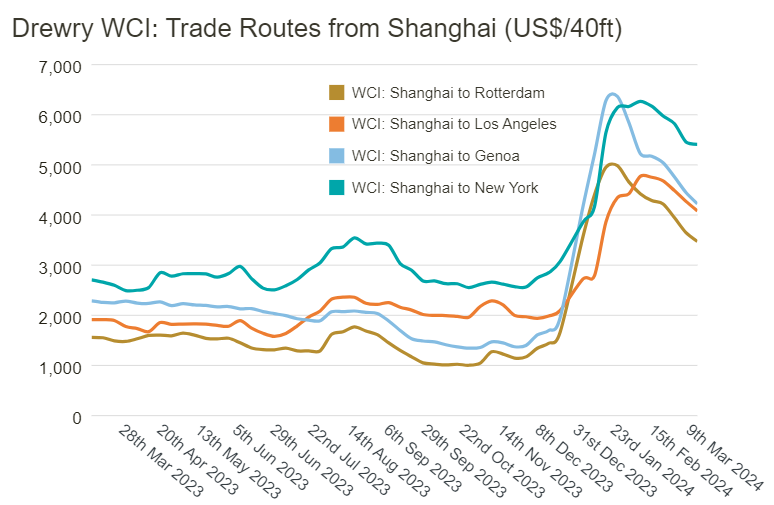

Examining specific trade routes, Drewry’s analysis reveals notable changes in container freight rates. For instance, rates from Shanghai to Rotterdam and Genoa experienced a 5% decrease, settling at $3,473 and $4,223 per 40-foot container, respectively. Similarly, rates from Shanghai to Los Angeles saw a 4% decline to $4,082 per feu.

Conversely, rates on certain routes witnessed slight fluctuations, with Rotterdam to Shanghai rates decreasing by 2% while rates on the Los Angeles to Shanghai and Shanghai to New York routes dropped by 1%. Notably, rates from New York to Rotterdam and Rotterdam to New York displayed modest increases, highlighting the dynamic nature of global trade flows.

Looking ahead, Drewry anticipates continued downward pressure on spot rates ex-China in the coming weeks, reflecting the evolving market dynamics. However, container freight rates on transatlantic routes are expected to remain relatively stable, underscoring the importance of closely monitoring market trends and adapting strategies to navigate the complexities of international trade.

Source: Drewry Supply Chain Advisors