In the fast-paced world of container shipping, staying informed about freight rates is essential for businesses to make informed decisions. Drewry, a leading maritime research and consulting firm, provides valuable insights into the dynamic container freight market through its World Container Index (WCI) and Container Freight Rate Insight (CFRI) online service.

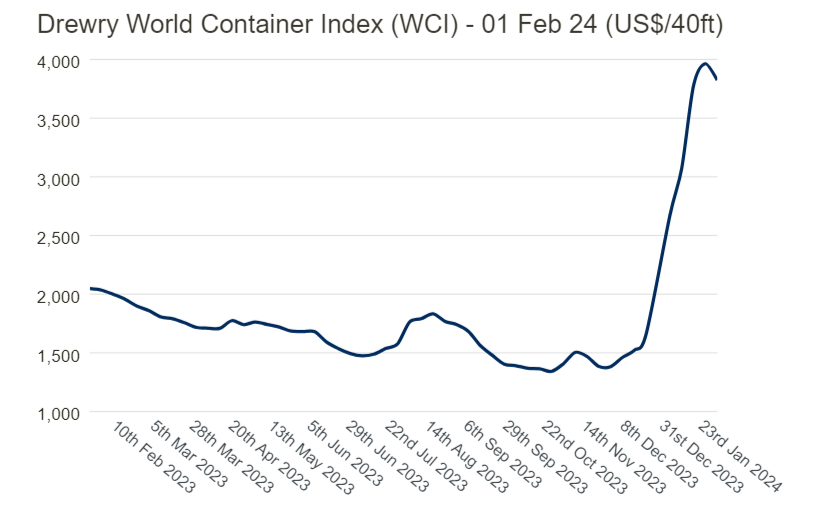

Drewry’s latest WCI report reveals a 4% decrease in the composite index to $3,824 per 40ft container as of February 1st.

Despite this decline, there has been an impressive 88% increase compared to the same week last year, reflecting the volatility of the market.

The year-to-date average composite index of $3,461 per 40ft container surpasses the 10-year average rate, underscoring the ongoing impact of the pandemic on global trade.

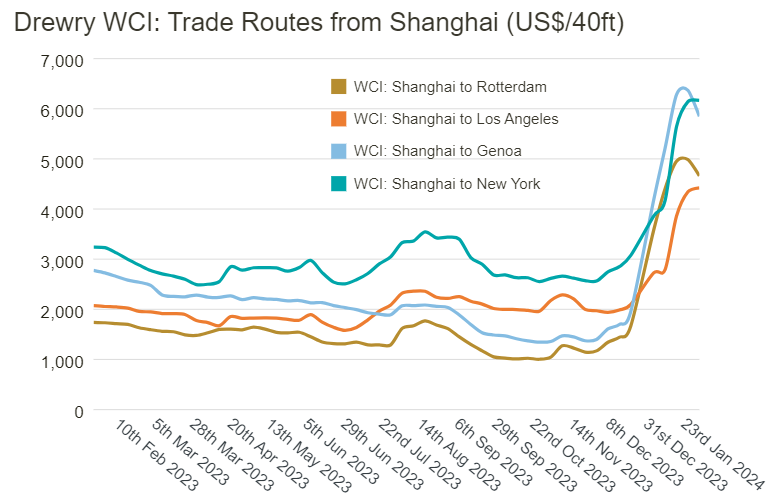

The report also highlights specific changes in freight rates on key routes. For instance, there was an 8% decrease in rates from Shanghai to Genoa, while rates from Shanghai to Rotterdam and Rotterdam to Shanghai saw a 6% decline.

Conversely, rates from Los Angeles to Shanghai dropped by 4%, while rates from New York to Rotterdam increased by 3%.

These fluctuations underscore the complex nature of the container shipping market, influenced by factors such as supply chain disruptions and geopolitical events.

To provide comprehensive coverage of the container freight market, Drewry’s CFRI online service offers data on over 790 global port pairs, updated monthly.

Whether businesses need information on routes not listed in the WCI report or want to track trends over time, CFRI provides the necessary insights to navigate the complexities of the container shipping industry.

In conclusion, Drewry’s insights into container freight rates offer invaluable guidance for businesses operating in the global trade landscape.

By leveraging the WCI report and CFRI online service, companies can stay ahead of market trends and make informed decisions to optimize their supply chain operations.

Source: Drewry.com.uk